When long-term government bond yields are low enough, further declines can ‘feed on themselves’. European insurance companies and pension funds are plausible catalysts. The duration gap between their liabilities and assets typically widens non-linearly when yields are low and compressed further, triggering sizeable duration extension flows.

Domanski, Dietrich, Hyun Song Shin and Vladyslav Sushko, “The hunt for duration: not waving but drowning?”, BIS Working Papers, No 519, October 2015.

http://www.bis.org/publ/work519.pdf

The below are excerpts from the paper. Headings, links and cursive text have been added.

On the broader systemic consequences of ultra-low bond yields and their self-reinforcing character also view post here and here.

Life insurers, pension funds and bond markets in Europe

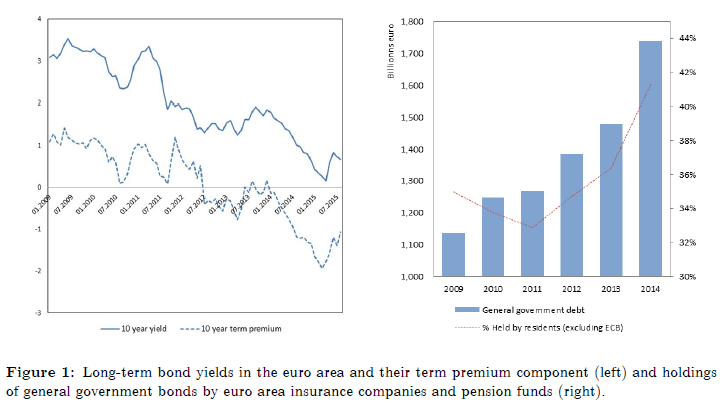

“Insurance companies and pension funds constitute a large segment of the euro area investor base. By end-2014, their combined assets exceeded EUR9 trillion, or almost 90% of euro area GDP…The products offered and business models of life insurers and pension funds are very similar across European countries.”

“The portfolios of insurance firms are much larger: by end-2014 they held in aggregate about three times as much assets (EUR 6.8 trillion) as pension funds (EUR 2.2 trillion)….Institutional arrangements lead to a particular emphasis on duration mismatches in the asset-liability management of insurance firms…Fixed income securities are the predominant asset class in the portfolios of euro area insurers….Taken together, direct and indirect holdings of fixed income instruments by euro area insurance firms amount to about 55% of their assets. Pension fund assets are smaller and the portfolios of such entities typically hold a lower proportion of bonds than those of insurance firms.”

“Investments reflect the liability-driven character of the life insurance business. Policyholders pay up-front premia, which life insurers invest in assets that match their liabilities…Immunisation strategies naturally favour instruments with relatively low credit risk and stable cash flows over long time horizons typically long-term government bonds over riskier corporate debt or equity investments. As a consequence, insurance companies are among the largest investors in euro area government bond markets: by end-2014, they accounted for about 40% of the holdings of government debt by euro area residents…In addition to cash instruments, derivatives can also be used for duration matching. Entering an interest rate swap as receiver of fixed rate payments allows investors to increase duration with no, or limited, upfront payment. However, replicating the duration of a long-term bond requires taking relatively large swap positions. In addition…, investors can use options to enter an interest rate swap at a future date (swaption) to hedge interest rate risks.”

“Life insurers and pension funds typically have long-term fixed obligations to policy holders and beneficiaries. In many cases, these liabilities have a longer maturity profile than that of the fixed income assets held to meet those obligations, implying a duration mismatch that fluctuates with movements in long-term interest rates. Prudent management of interest rate risk influences the choice of the asset portfolio toward matching the sensitivity of assets and liabilities to further changes in long-term rates. Accounting rules and solvency regulations may reinforce the imperative to manage duration mismatches.”

“Using market-based discount factors instead of fixed statutory discount rates will result in larger fluctuations of the value of liabilities…Against this background, the forthcoming introduction of the Solvency II regulatory framework might already have made the portfolio decisions of insurance firms more sensitive to the sharp decline in long-term interest rates. In particular, the present value of liabilities is calculated by estimating the present value of the expected net payments to policy holders and using a discount rate curve based on the euro swap rate curve. Hence, shifts in the market term structure affect the fair value of liabilities much more immediately than under the current Solvency I regulatory framework.”

On the global systemic consequences of Solvency II view post here.

The theory of the duration feedback loop

“The duration-matching strategies of long-term investors can amplify movements in long- term interest rates. When long-term rates fall, the duration of both assets and liabilities increases, but negative convexity [negative non-linear relation between the implied position value and the discount rate] implies that the duration gap [gap between interest rate sensitivity of liabilities and assets] becomes larger for any given portfolio of bonds. Closing the duration gap entails adding longer-dated bonds so that the duration of assets catches up with the higher duration of liabilities”

“Because of negative balance sheet convexity, the duration of liabilities rises faster than the duration of assets, and this gap widens non-linearly with a fall in rates. Hence, for some ranges of long-term interest rates especially for low or negative rates, an increase in the price of a bond elicits greater demand for that bond. In other words, the demand function slopes upwards.”

“If a sufficiently large segment of the market is engaged in such portfolio rebalancing, the market mechanism itself may generate a feedback loop whereby prices of longer-dated bonds are driven higher, serving to further lower long-term interest rates and eliciting yet additional purchases.”

“Hence, balance sheet duration of insurer bond holdings may exert analogous impact on German government bond yields as does the duration exposure of MBS investors on Treasury yields in the U.S.…A well-known issue is convexity risk due to the prepayment option in US mortgage contracts… The common thread between the mechanism examined in our paper and MBS hedging is that the dynamic hedging of negative convexity (where the duration of liabilities changes faster than that of assets) may create a feedback loop between investor hedging and market prices.”

Evidence for the duration feedback loop

“We examine the maturity profile of government bond holdings of the insurance sector in Germany using data provided to us by the Deutsche Bundesbank, with a special attention on how the maturity of bond holdings adjusts to shifts in long-term interest rates…

- In just one year between 2014 and 2015, the long end of the euro swap curve declined by over 150 basis points. The swap rate compression was also associated with a rapid rise in the costs of swaptions…For 2014 we document the largest portfolio reallocation towards government bonds by the insurance sector observed during the past four years. The nominal value of government bond holdings increased by 16% compared with an average of 6.9% for the preceding three- year period…

- This portfolio reallocation was accompanied by a significant increase in the duration of government bond holdings, by almost 40% (from 11.3 years to 15.7 years in 2014). At the same time, the duration of liabilities rose sharply in 2014, by an estimated 20% (from 20.5 years to 25.2 years)…

- The hunt for duration seems to have amplified the decline in euro area bond yields in 2014. We find that the demand response of German insurers to government bonds became upward-sloping in 2014. The relationship between bond prices and bond demand is non-linear in bond duration, a result that is robust to alternative regression specifications. Statistical tests confirm that duration is the state variable that determines the sign of the price-elasticity of bond demand by the insurance sector.

- The hunt for duration by the insurance sector appears to be distinct from the typical search for yield. We do not find a similar demand response for other sectors in Germany, including investment funds, banks and private households.

- Our data allow for only a tentative estimate of the impact of insurers’ portfolio shifts on market yields. However, the feedback effects from rising bond demand in an environment of falling yields may have been significant. In 2014, German insurers were responsible for about 40% of the net acquisition of bonds by German residents, even though insurers only account for 12.5% of the direct holdings of bonds by German residents. “

“Three observations suggest that … the hunt for duration is a more widespread phenomenon …

- First, insurance companies and pension funds are important investors in the euro area as a whole. At end-2014, they accounted for about 41% of the outstanding amount of euro area sovereign debt held by euro area residents.

- Second, insurers run negative duration gaps in a number of countries.

- And third, insurers in Europe are subject to comparable regulatory constraints, not least due to the forthcoming introduction of the Solvency II Directive in 2016.”