ECB research suggests that its 2015 asset purchase programme significantly compressed term and credit spreads. Unlike previous asset purchases, it did not tackle financial distress. It functioned mainly through the broad compression of risk premia and spill-over to non-targeted assets.

Altavilla, Carlo, Giacomo Carboni and Roberto Motto (2015), “Asset purchase programmes and financial markets: lessons from the euro area”, ECB Working Paper 1864, November 2015

http://www.ecb.europa.eu/pub/research/working-papers/html/index.en.html

The below are excerpts from the paper. Headings, links and cursive text have been added.

What’s ‘APP’ (and other acronyms)?

“On 4 September 2014 the ECB announced a purchase programme of covered bonds (CBPP3) and a purchase programme of asset-backed securities (ABSPP)….On 22 January 2015 the ECB decided that asset purchases should be expanded to include a public sector asset purchase programme (PSPP). The combined CBPP3, ABSPP and PSPP constitute the ECB asset purchase programme (APP).”

“The APP had the objective to provide additional monetary policy stimulus in face of increasing deflation risks and to ease borrowing conditions of households and firms…

- The programme consists of combined monthly purchases of EUR60 billion of public and private securities, intended to be carried out until September 2016, and in any case until the Governing Council of the ECB sees inflation stabilising at values consistent with its inflation aim…The targeted residual maturity of public securities is 2 to 30 years…

- Purchases under PSPP are directed for a share of 88% to nominal and inflation-linked securities issued by euro area central governments and recognized agencies, and for the remaining 12% to bonds issued by international organisations and multilateral developments banks located in the euro area.

- [The cumulative] intended purchases until September 2016…[at time of announcement had been] EUR1.14 trillion, representing 11% of the annualised 2014Q4 euro area GDP…The largest asset purchase programme carried out by the US Federal Reserve during the global financial crisis, the LSAP1 of 2008-2009, had a comparable size amounting to 12% of US GDP at the start of the programme.”

For all the key points of the ECB asset purchase programme view post here.

“[Previously] the ECB [had] launched…two small purchase programmes targeting covered bonds issued by euro area banks …the so-called CBPP1 of EUR60 billion in 2009, and CBPP2…[with] around € 16 billion purchases when ended in 2012.”

General research findings on asset purchase programs

“Existing literature suggests that large-scale asset purchase programmes tend to be more effective on asset prices in periods of high financial distress…The impact on assets targeted by the programmes carried out in the aftermath of the collapse of Lehman is generally found to be stronger than the one exerted by subsequent programmes implemented when financial market distress receded. “

“There are multiple channels through which asset purchases affect financial markets, with ‘narrow channels’ being relatively more important than ‘broad channels’…Channels are defined as ‘narrow’ when the impact is concentrated on the assets targeted by the programme, with little spill-overs to other market segments. “

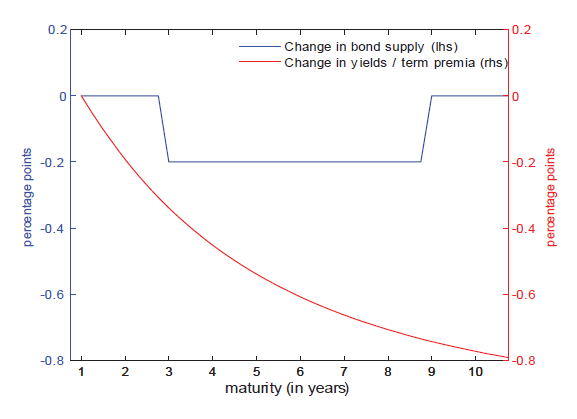

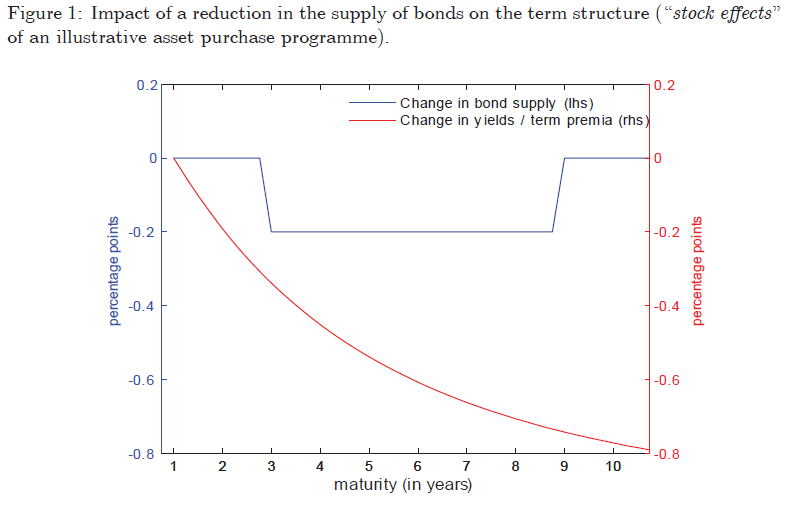

“The bulkof the impact of purchase programmes is found to arise at announcement (‘stock effects’), whereas ‘flow effects’ generated by the actual implementation of the purchases are limited…Stock effects of asset purchases [means that] asset purchases affect bond yields via financial markets’ reactions to current and expected future withdraws of bond supply, in anticipation to the actual purchases taking place.”

Analysis of the ECB’s APP

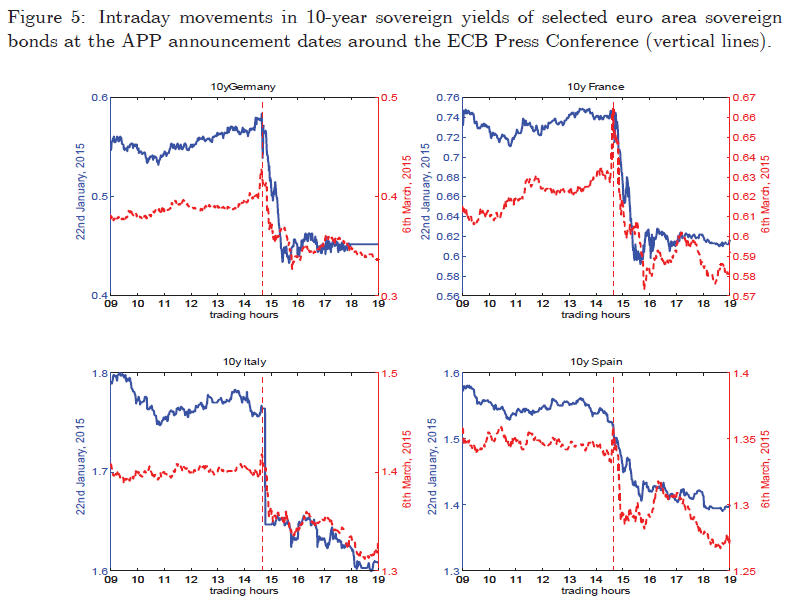

“We employ an event-study methodology…We identify a broad set of events based on ECB’s official communication interventions…We then validate this ‘narrative’ approach…with…an index of intensity of news coverage about the likelihood of a purchase programme…We [also] employ an event-study assessment based on a regression analysis that explicitly controls for macroeconomic releases…to sharpen our identification of the channels of transmission, we also make use of high-frequency intraday data.”

“The APP has significantly lowered yields for a broad set of market segments, with effects that generally rise with maturity and riskiness of assets.

- Sizeable impact is estimated, for instance, for long-term sovereign bonds, with yields declining by about 30-50 basis points (depending on the approach) at the 10-year maturity for the implied euro area term structure, and by roughly twice as much in higher yield member countries such as Italy and Spain.

- At 20-year maturity, the effects tend to be more persistent with the two-day window changes ranging from 30 basis points in Germany to 80 basis points in Spain.”

For comparison with the estimated impact of Fed asset purchases on term premia view post here.

“Financial conditions at the announcement of the ECB’s programme were stable, and various yields and spreads already compressed… low financial distress, while indeed weakening certain transmission channels, has reinforced other channels because of its interplay with the asset composition of the programme.…

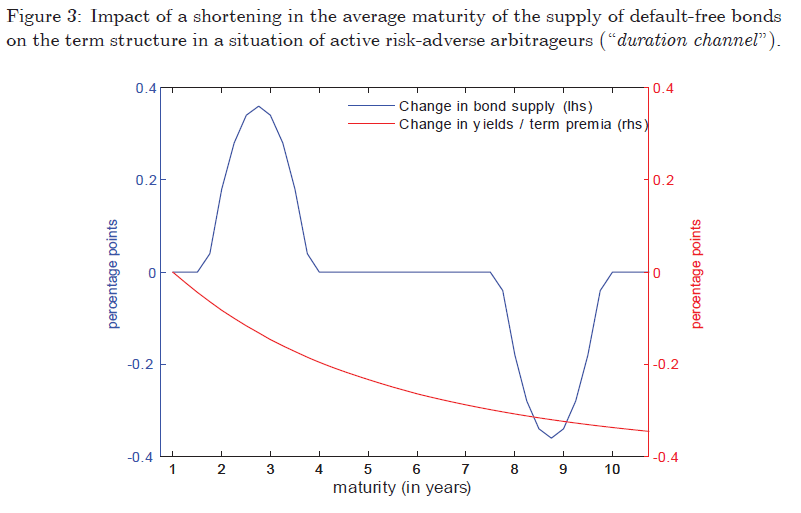

- When financial stress recedes and the risk-bearing capacity by arbitrageurs rises… An asset purchase programme that shortens the maturity structure of the supply of default-free bonds held by the private sector…lowers bond yields across all maturities via a compression of premia in case arbitrageurs are active market participants…with a more pronounced magnitude at long maturities (“duration channel”)…and for lower-rated securities (“credit channel”)….

- At the same time, the low degree of financial stress… has facilitated spill-overs to non-targeted assets…The impact of purchases spills over to other non-targeted assets, as long as arbitrageurs are effective in integrating market segments (“portfolio rebalancing”)…For instance…non-targeted corporate bonds… spreads relative to risk-free rates have declined by about 20 basis points for both euro area financial and non-financial corporations, a sizeable spill-over intensity when viewed through the lens of historical regularities.”

“Our findings provide support for the view that the effects of asset purchases are not limited to times of financial market stress, but the strength of the channels of transmission might differ across risk and liquidity regimes. In particular, at the centre of the relatively strength of “narrow” versus “broader” channels of transmission is the effectiveness of marginal investors to integrate across market segments, largely related to their risk-bearing capacity.”