Negative nominal interest rates and term premia are an issue for financial stability in Europe, according to a recent speech by the Deputy General Manager of the BIS. Duration risk has surged and banks’ exposure to sovereign credit and long-term rates has been compounded by flawed capital regulation. Governments find it easier to live with high debt levels for now, but at the expense of a weaker financial position of insurance companies and pension funds.

Hanoun, Herve (2015), “Ultra-low or negative interest rates: what they mean for financial stability and growth”, speech at the Eurofi High-Level Seminar, Riga, 22 April 2015

http://www.bis.org/speeches/sp150424.pdf

On the danger of a self-reinforcing erosion of real interest rates with secular stagnation and related systemic risks view post here.

On the compression of inflation compensation in long-term bond yields view post here.

The below are excerpts from the speech. Emphasis and cursive text have been added.

An unprecedented situation

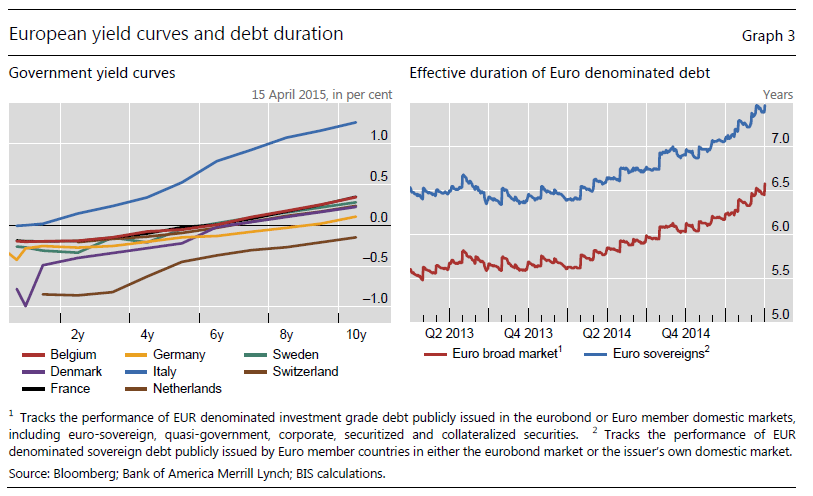

“Most of continental Europe have moved towards…introducing negative policy interest rates…Together with forward guidance and large scale asset purchases, such measures have created an unprecedented situation where nominal interest rates…are negative across a range of maturities in the benchmark yield curve, from overnight out to five years.”

“The upshot is that, instead of paying interest, a number of governments in continental Europe are now being paid to borrow. For their part, investors are currently not compensated for taking interest rate risk. There is no precedent in economic history for negative nominal interest rates, even during the Great Depression in the United States.”

The consequences for financial risk taking

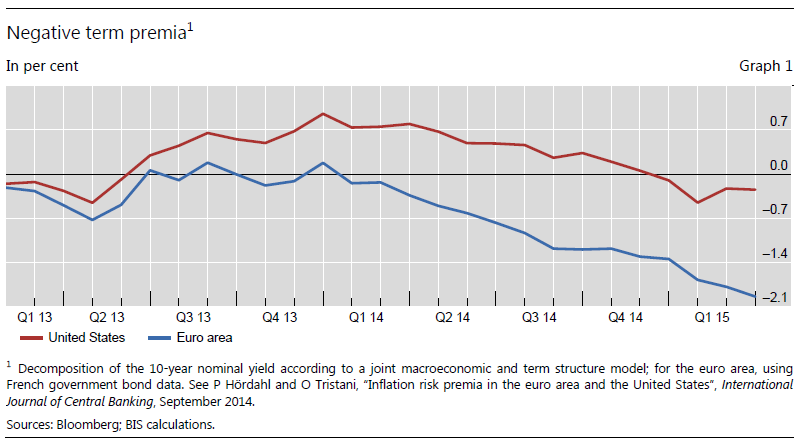

“In their search for yield, investors also reach for duration, pushing into negative territory the term premium – which is supposed to compensate investors for the risk of holding long-duration bonds. In reaction to negative yields in the short- and medium-term segment of the euro zone sovereign yield curves, investors are piling up interest rate risk by investing in long-dated securities at very low yields. And, in fact, the effective duration of euro-denominated debt has risen significantly since the second half of 2014. As a result, an eventual normalisation of long-term yields would inflict significant and widespread losses on investors, with potentially serious consequences for financial and economic stability.”

“This makes it a matter of urgency to address the gap in global regulation on interest rate risk in the banking book. Pillar 1 currently does not provide for any capital charge against this risk, an anomaly that will, we hope, soon be corrected by the Basel Committee on Banking Supervision. As monetary policymakers, central banks in Europe have contributed heavily to the build-up of duration risk by bringing nominal yields in the two- to five-year part of the yield curve down to near zero and even negative levels. As supervisors or systemic risk managers, they should ensure that commercial banks are allocating enough capital to cover the interest rate risk they are accumulating. All this puts a premium on introducing a Pillar 1 charge on interest rate risk in the banking book as soon as possible.”

“Three major regulatory reforms that could to some extent mitigate the financial stability risks resulting from ultra-low interest rates are still under discussion. These are the calibration of the leverage ratio for banks in Basel III, the introduction of a Pillar 1 capital charge for the interest rate risk in the banking book, and the equally urgent elimination from EU bank regulation of the zero risk weight for sovereign exposures.”

The consequences for financial relations

“The winners of the ultra-low interest rate policy will be the most highly indebted economic agents, namely governments. The losers will be savers, pensioners and life insurance policy holders. “

“With interest rates at ultra-low levels, governments are under no pressure to reduce their debt. Negative rates actually encourage them to borrow more. And if government borrowing becomes a free lunch, there is a clear disincentive for fiscal discipline…The euro zone public debt-to-GDP ratio has surged from 73.3% to an estimated 108.4% between 2007 and 2015, while net interest payments have fallen from 2.5% to 2.2% of GDP…The disincentive to fiscal consolidation has two elements. First, ultra-low interest rates flatter the debt service ratio, painting a misleading picture of debt sustainability. Fiscal reforms can be put off indefinitely, undermining fiscal discipline. Second, ultra-low or negative interest rates and large-scale government bond purchases lead to an artificial compression of sovereign spreads, and a weakening of market discipline.”

“Insurance companies’ and pension funds business models are also put at risk by ultra-low rates. They may find themselves unable to meet fixed long-term obligations. Life insurance firms will be less able to meet guaranteed returns. And the free fall in the discount rates inflates dramatically pension liabilities, eating deeply into the solvency of pension funds.”