The importance of collateralized transactions for the global financial system has greatly increased since the financial crisis. Moreover, the influence of central banks on supply and pledgeability of collateral has become more pervasive and explicit. Investment managers must calculate with the impact of central bank policy and operating frameworks on financial conditions via this “collateral channel”.

Committee on the Global Financial System, Markets Committee (2015), “Central bank operating frameworks and collateral markets”, CGFS Papers, No 53, March 2015.

http://www.bis.org/publ/cgfs53.htm

The below are excerpts from the paper. Emphasis and cursive text have been added.

On the use of collateral frameworks as a policy tool in the euro area view post here.

On the relation between collateral markets and liquidity crises view post here.

On the role of shadow banks in collateral markets and collateral chains view post here.

Understanding collateral markets

“Collateral facilitates the intermediation of funds from savers to borrowers…Collateral assets are any assets that can be used by financial market participants to collateralise a creditor’s claim in normal market conditions, as well as any other assets that are likely to be used as collateral in a stressed environment. A collateral market is then simply a market that involves collateral assets.”

“It is useful to think about collateral assets as a subset of all financial assets, with their key defining feature being market participants’ ability to pledge them against borrowed funds. Different collateral assets may have different degrees of pledgeability, which measures the quantity of collateral services an asset provides. Total pledgeability can then be thought of as the product of two components: first, the total size of a given collateral market; second, the extent to which each individual unit of collateral can be used to generate funding.”

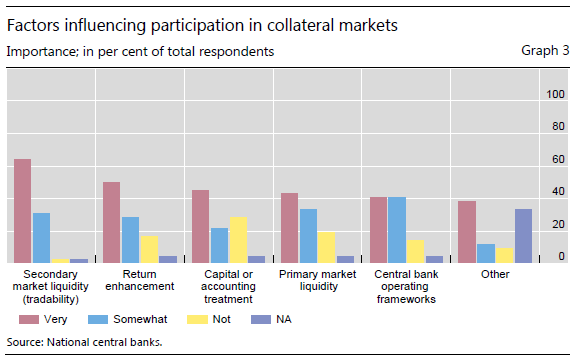

“Whether or not assets may serve as collateral depends not only on features of the assets themselves…but also on the willingness of market participants to accept or reject these assets as collateral. Such decisions depend on the assessment of other risks associated with the assets, including credit and liquidity risks. The definition of what is or is not a collateral asset can therefore in part be endogenous to evolving market practice…To be pledgeable, an asset must typically be relatively easy to value and amenable to legal segregation. Moreover, marketable assets tend to have a higher degree of pledgeability than non-marketable ones. Government debt, for example, commonly serves as collateral for repo transactions for both the private sector and central banks.”

“By reusing collateral, securities can theoretically be used multiple times to collateralise different transactions, increasing the effective supply of collateral assets for a given stock of securities at both the individual and aggregate levels.”

“Typically, in ‘normal’ times, many central banks tend to accept only a subset of the collateral used in private transactions…Equities, for example, are used as collateral assets by the private sector but are not generally acceptable in central bank operations…In crisis times, collateral acceptance typically becomes more conservative in private markets, and the pool of assets deemed suitable as collateral shrinks as the perceived risk of assets and counterparties rises. Central banks, on the other hand, often find that they need to expand the range of assets eligible as collateral during.”

How central banks affect collateral markets

“What makes central banks special as participants in collateral markets is that they are the only counterparties that are free of counterparty and liquidity risk. As a result, central banks can, if they wish to, transact in ways that are fundamentally different from private market participants, for example in order to see through temporary variations in liquidity.”

“Central bank operations are, in essence, asset swaps which alter the mix of assets available for use by private market participants. For example, a central bank that is providing liquidity to the financial system will typically either take collateral or purchase assets outright – so that, in either case, the central bank liquidity provided may be partly offset by a reduction in the stock of assets available for use as collateral in private transactions, such as repurchase agreements…These effects have the potential to become more important, due to any greater scarcity of collateral assets stemming from the global financial crisis and resulting regulatory changes.”

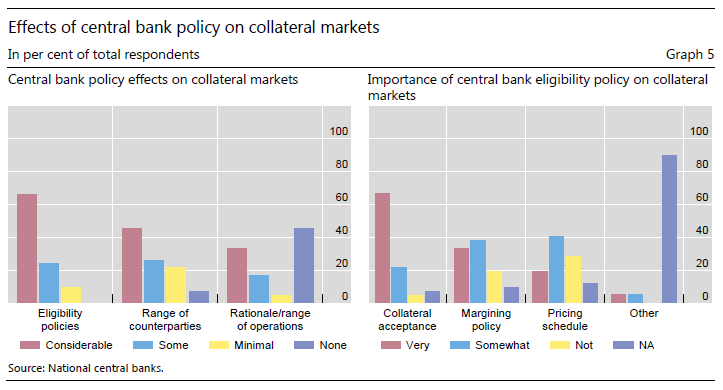

“Central banks have a number of design choices at their disposal that can influence markets for collateral – either through the supply of assets available for use as collateral, the pledgeability of various assets as collateral for private transactions, or both…Examples include the loosening of eligibility criteria by the Eurosystem during the recent euro area sovereign debt crisis, as well as the various support programmes implemented by the US Federal Reserve to support collateral markets at the height of the financial crisis.”

“Central bank actions can impact collateral markets through a scarcity channel and a structural channel. Scarcity effects result from the impact of central bank operations on the prices, rates, and price volatility of collateral assets arising from changes in the availability of collateral, or the collateral composition of the market.”

“Structural effects include effects from the designation of eligible securities, as well as changes in clearing and settlement systems and other infrastructure support…In principle, announcement of eligibility can have an impact even before the new policy is formally in effect. For example, the Bank of Canada’s announcement of different phases of its term Purchase and Resale Agreement facility was associated with both a transitory and a persistent reduction in the liquidity premium for banks’ three-month funding costs – an average reduction of 9 basis points in the three month CDOR-OIS spread.”

“In normal times, when central banks tend to operate at the margin and on a limited scale, they typically set the features of their operating framework to be market-neutral…Crisis times, on the other hand, are associated with greater scarcity of collateral in the financial system, as declining market confidence prompts a shift from unsecured to secured financing. Under such conditions, central banks may operate on a much larger scale, in some instances also inducing unintended side effects on collateral markets that have to be managed. Moreover, they are more likely to attempt to directly influence the functioning of collateral markets, for example by introducing facilities that allow banks to post illiquid collateral assets in place of liquid securities that, in turn, can be used to obtain funding in the private market.”

The challenges for systemic risk management

“The use of collateral has risen considerably in the aftermath of the financial crisis, and may well increase further as risk management practices continue to evolve and as financial institutions respond to regulatory changes.”

“The effects of central bank operations on collateral markets should be monitored carefully, particularly in connection with unconventional monetary policies and the eventual exit from those policies. Once central banks start to normalise their monetary policies, they will need to consider the implications for collateral markets of different tools available for use in that process.”

“One area of planning [for future crisis events] is to consider what constitutes a suitable inventory of assets for use in collateral transformation activities (i.e. in order to supply high-quality assets into the market, as needed against lower-quality or less liquid assets). Another aspect is whether the central banks’ risk management capacity is sufficient to assess asset quality for an enlarged pool of assets, if necessary, and to set appropriate haircuts. Moreover, some central banks may need to take steps to ensure they have adequate operational capacity to handle new types of collateral at short notice in a crisis situation.”