China’s economy has long relied on compressed interest rates in conjunction with strict capital controls and a tightly managed exchange rate. A new ADBI paper suggests, however, that modest liberalization and gradual internationalization of the renminbi since 2005 have lessened state control over financial parameters. Inconsistencies and risks of market dislocations have become more evident.

Kawai. Masahiro and Li-Gang Liu (2015), “Trilemma Challenges for the People’s Republic of China”, ADBI Working Paper Series, No. 513, February 2015

http://www.adbi.org/files/2015.02.10.wp513.trilemma.challenges.prc.pdf

The below are excerpts from the paper. Emphasis and cursive text have been added.

The very basics of China’s monetary policy

“The objective of the PRC’s [People’s Republic of China’s] monetary policy is to maintain price stability so as to promote economic growth under the mandate of the law of the People’s Bank of China. To achieve these dual policy objectives, the monetary authority may use various policy instruments such as reserve requirement ratios, central bank benchmark lending and deposit interest rates, re-discounting, central bank lending, open market operations, and other administrative or window guidance measures. “

“The PRC’s authority applies both quantity and price instruments to conduct monetary policy while being constrained by the less efficient financial system…The monetary authority first sets numerical targets for the quantity of money supply and credit growth as its intermediate quantity targets at the beginning of each year, and then monitors these intermediate targets closely during the course of the year and fine-tunes deviations from these targets by a number of policy instruments.”

Local interest rate controls

“The PRC has used financial repression in the form of controlled interest rates and credit allocation with an aim to support investment and economic growth. Interest rate controls and other financial repression measures have also led to the underdevelopment of the financial sector, inefficient allocation of savings, excessive investment, and overcapacity in certain sectors of the economy.”

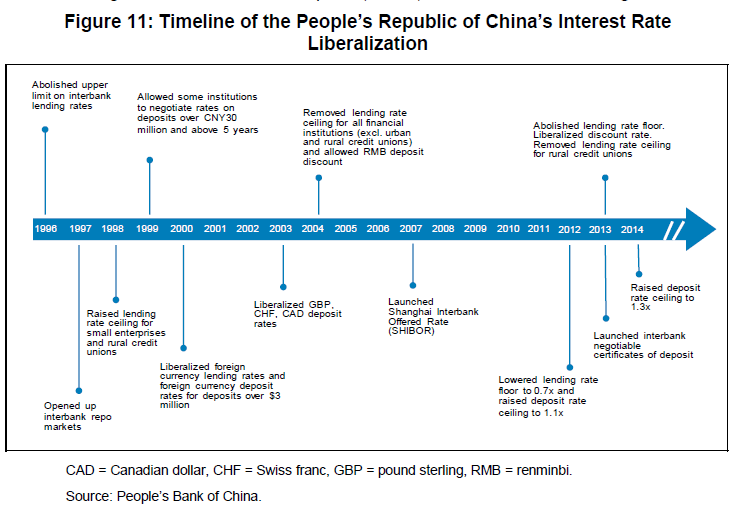

“In 1996, the PRC embarked on interest rate reform by gradually liberalizing interbank lending rates [see timeline below]…Among the recent policy changes, one of the most significant was the removal of the bank lending rate floor in July 2013, which allowed banks to freely set their own lending rates…After the removal of the lending rate floor, the monetary authority launched a system for a prime loan rate (PLR) in October 2013. This is an indicative interest rate at which commercial banks lend to their prime customers…The PLR could replace the current benchmark policy lending rate and be gradually used as a new market-driven benchmark for lending rates. The PRC’s deposit rate remains controlled. To add some flexibility to the controlled deposit ceiling rate, the authority has been taking a gradual approach to liberalizing bank deposit rates…Large deposits are now priced according to market demand and supply.”

Foreign exchange policy

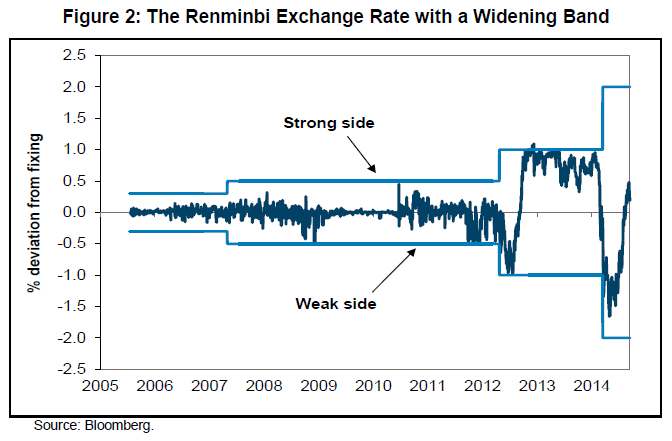

“The PRC used to peg the RMB tightly to the US dollar, but exited from the dollar peg in July 2005. It began to engineer currency appreciation against the US dollar by shifting to a crawling-peg regime, thus allowing a certain degree of exchange rate flexibility. Although the authority temporarily restored a dollar-peg regime in August 2008–May 2010, it once again adopted a crawling-peg-like regime in June 2010. In general, the degree of exchange rate flexibility has gradually increased over time but remains highly limited.”

“The post-2005 RMB exchange rate regime has not truly referenced a basket of a wide range of currencies in setting the value of the RMB exchange rate. The RMB exchange rate has relied and continues to rely heavily on the US dollar as its anchor currency, with limited exchange rate volatility.”

“The authority announced a daily reference trading spot rate, called the central parity rate (CPR)…The RMB trading band vis-à-vis the US dollar was initially set at a tightly controlled range of ±0.3%, which was later widened to ±0.5% in May 2007, ±1% in April 2012, and then to ±2% in March 2014. Indeed, the RMB’s exchange rate flexibility has increased progressively with an enlarged trading band over time. Although the RMB exchange rate band has been widened over time, RMB volatility has been limited in comparison to the volatility of other freely floating currencies such as the euro, yen, and Australian dollar.”

External capital account controls

“While strict controls used to be imposed on portfolio investment flows, these controls have also been relaxed in recent years to expand the range of investors and the type of financial assets permitted for cross-border transactions. The authorities introduced the system of qualified foreign institutional investors (QFII) for inward portfolio investment and that of qualified domestic institutional investors (QDII) for outward portfolio investment. The policy of internationalizing the renminbi (RMB), launched in the wake of the global financial crisis (GFC), has also facilitated greater financial market openness. Authorities now allow firms to settle merchandise trade in RMB, permit non-residents to hold offshore RMB deposits, and allow both PRC residents and non-residents to issue offshore RMB bonds and equities.”

“[The policy of internationalization of the renminbi] led to rapid increases in the number of RMB offshore trading centers… Among these offshore trading centers, the RMB market of Hong Kong remains the largest and most active. Total RMB deposits in the banking system of Hong Kong, China, including certificates of deposit, exceeded CNY1.2 trillion in the first half of 2014, a sizable amount comparable to the value of the PRC’s new loans extended per year before 2005… Meanwhile, offshore capital markets for the RMB have also developed rapidly. The RMB bond market of Hong Kong, China, nicknamed the ‘dim sum’ market, experienced a surge with a total outstanding amount of CNY310 billion in 2013 and CNY374 billion in Q3 2014.”

“At this stage, the PRC’s capital control regime is unevenly enforced. Capital inflows have had limited controls while capital outflows are still under severe restrictions. Therefore, large interest rate differentials with small exchange rate volatility have attracted large capital inflows, which have forced the authority to engage in larger currency market interventions and accumulate foreign exchange reserves. “

The consequences of liberalization and reform

“While the PRC’s financial markets have become increasingly integrated with external markets, particularly those in Hong Kong, China, the degree of RMB exchange rate flexibility has not risen much, and the combination of greater openness of its financial markets and lack of sufficient exchange rate flexibility has constrained the ability of the monetary authority to pursue autonomous monetary policy…As a result, the authority’s ability to set autonomous monetary policy has been constrained. This could lead to the accumulation of domestic macroeconomic and financial imbalances, which could eventually lead to financial crises in the future.”

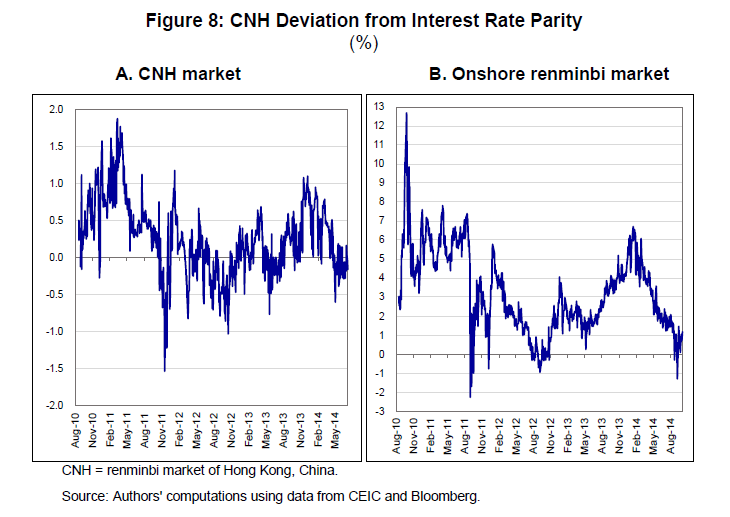

“The two charts [below]…provide two capital control effectiveness measures, one based on the CNH [offshore Chinese renminbi] forward rate and the other the NDF [non-deliverable forward] rate…We observe that capital control effectiveness has been declining since September 2011, when the CNH market in Hong Kong, China began to grow larger, become more liquid.”

“The PRC’s unaccounted capital flows have started to grow over time. Until 2008, errors and omissions in the PRC’s balance of payments had been around USD10–20 bn, mostly in the form of unaccounted inflows, coinciding with the expectation of RMB appreciation. Since 2009, errors and omissions have become large outflows, at an average of close to USD55 bn. Errors and omissions numbers became even larger in 2012–2013 to around USD82 bn, suggesting that the leakage from capital controls has become larger over time, even when the RMB exchange rate has been on a steady appreciation.”

“Large swings of interest rates and loan quantities were observed during June–July 2013…A sudden re-pricing of counter-party risk brought about a surge in the short-term interest rate…The 7-day repo rate, a reliable indicator measuring market liquidity conditions, surged to almost 12% from less than 4% in a day, with the high rate lasting for 2 weeks. The market panic created ‘cash crunches’ in the PRC’s interbank markets. The authority finally injected liquidity into the banking system 2 weeks later via the short-term lending facility (SLF), which eased market liquidity conditions in July 2013. The 7-day repos remained quite volatile until January 2014 after the authority engaged in “double interventions… in both the foreign exchange and money markets… leading to RMB depreciation and money market rate declines. Since the June 2013 ‘cash crunches’ the authority appears to have become more proactive in managing money market liquidity conditions.”