Recent FSB reports give an updated assessment of shadow banking. Non-bank financial intermediation in its broadest definition is estimated to be 120% of global GDP and growing. Its expansion is dependent on market prices for collateral. Dislocations can be contagious for banks. Regulatory policies may mitigate pro-cyclicality and contagion, but only modestly so.

Financial Stability Board, “Global Shadow Banking Monitoring Report 2014”, 30 October 2014

http://www.financialstabilityboard.org/wp-content/uploads/r_141030.pdf

Financial Stability Board, “Transforming Shadow Banking into Resilient Market-based Financing”, 14 November 2014

http://www.financialstabilityboard.org/wp-content/uploads/Progress-Report-on-Transforming-Shadow-Banking-into-Resilient-Market-Based-Financing.pdf

The below are excerpts from the paper. Emphasis and cursive text have been added.

The state of shadow banking

“The FSB has defined shadow banking as ‘credit intermediation involving entities and activities (fully or partly) outside the regular banking system’, or non-bank credit intermediation in short. Such intermediation, appropriately conducted, provides a valuable alternative to bank funding which supports real economic activity.”

“This report presents…end-2013 data…from 25 jurisdictions and the euro area as a whole… [representing] 90% of global financial system assets.”

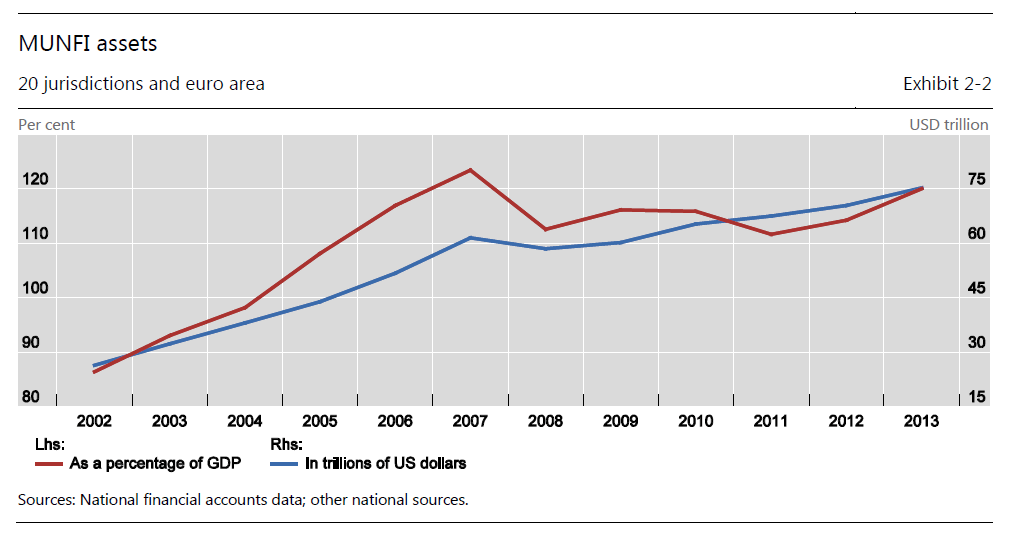

“Non-bank financial intermediation grew by USD5 trillion in 2013 to reach USD75 trillion. This provides a conservative proxy of the global shadow banking system, which can be further narrowed down…Globally, [non-bank financial intermediation] assets represent on average about 25% of total financial assets, roughly half of banking system assets, and 120% of GDP.”

N.B. MUNFI means Monitoring Universe of Non-Bank Financial Intermediation

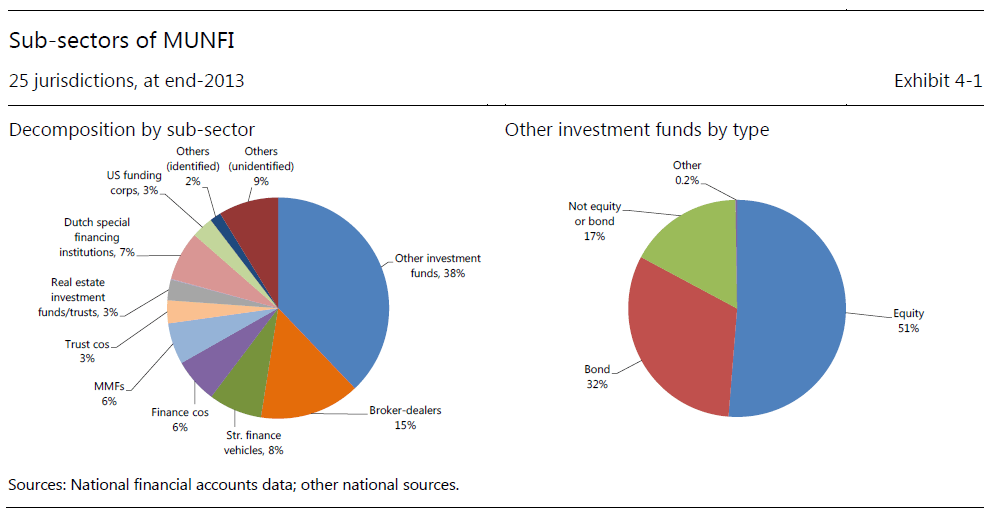

“Other Investment Funds [mostly real money equity and fixed income funds] were the largest non-bank financial intermediation sub-sector …which accounted for 38% of…assets in 2013, up from 34% in 2012…The second largest identified…sub-sector…was Broker-Dealers. Their assets amounted to 15% of non-bank financial intermediation assets…The third largest…sub-sector in 2013 was Structured Finance Vehicles. Their total financial assets reached…8%…down from 9% in 2012…Finance Companies’ assets were 6%… Money Market Funds’ assets totalled 6%…REITs [real estate investment trusts] and Trust Companies’ assets were…both accounting for 3%…Dutch Special Financing Institutions and U.S. Funding Corporations are the two large jurisdiction-specific…sub-sectors which held assets of USD4.6 trillion and USD2.0 trillion in 2013, respectively.”

“Insurance companies and pension funds (ICPFs) are not included in our nob-bank financial intermediation measure. However, insurance companies and pension funds are increasingly active in credit intermediation, sometimes by expanding lending activities traditionally performed by banks…Global ICPFs sector assets reached USD54.8 trillion in 2013, having grown continuously since 2008…At the end of 2013, ICPFs constituted 18% of total financial system assets and 88% of GDP.”

The troubles with shadow banking

“The global financial crisis exposed significant fault lines in shadow banking activities…When the prices of securitised assets fell, collateralised financing terms tightened, triggering fire sales in particular by leveraged and maturity mismatched investors. As funding markets seized up, investment vehicles failed, money market funds (MMFs) experienced runs, and credit intermediation through the shadow banking system came to a dramatic halt. The viability of the banking system was also threatened and the supply of credit to the real economy was drastically restricted.”

“Systemic risks can spill over from shadow banking entities to the banking sector…Direct linkages are created when shadow banking entities form part of the bank credit intermediation chain, are directly owned by banks, or benefit directly from bank support. Funding interdependence is yet another form of direct linkage, as is the holding of each other’s assets such as debt securities. In addition, indirect linkages also exist through a market channel, as the two sectors may invest in similar assets, or be exposed to a number of common counterparties. These connections create a contagion channel through which stress in one sector can be transmitted to the other, and can be amplified back through feedback loops.”

Size, motivation, and ownership of shadow banking operations are all critical for their systemic risk. On this view post here

On the risks of shadow banking activity through collateralized transactions at dealer banks view post here

Regulatory policies

“The FSB is coordinating and contributing to the development of policy measures in five areas…

- Mitigating risks in banks’ interactions with shadow banking entities…The BCBS [Basel Committee on Banking Supervision] has now finalised: (i) risk-sensitive capital requirements for banks’ investments in the equity of funds; and (ii) the supervisory framework for measuring and controlling banks’ large exposures…

- Reducing the susceptibility of MMFs to ‘runs’… In the US, the world’s largest MMF market…new rules will require a floating net asset value for prime MMFs with institutional investors (funds that experienced a run during the financial crisis), so that the daily share prices of these funds fluctuate along with the market value of the funds’ assets… For non-government MMFs with solely retail investors, the new rules provided boards of directors of these funds new tools, including liquidity fees and redemption gates, to manage redemptions pressures…

- Improving transparency and aligning incentives in securitization… IOSCO is currently undertaking a level one peer review on national/regional approaches to align incentives associated with securitisation, including risk retention requirements…

- Dampening pro-cyclicality and other financial stability risks in securities financing transactions such as repos and securities lending… In October 2014, the FSB published the regulatory framework for haircuts on non-centrally cleared securities financing transactions…to limit the build-up of excessive leverage outside the banking system…It consists of qualitative standards…and numerical haircut floors.”