Empirical analysis suggests that equity and bond returns in international markets are driven mostly by shocks to expected future real cash flows. Moreover, they interact with mutual fund flows. In particular, there is evidence of short-term “trend chasing” and overreaction. Bond market returns and flows are also jointly driven by U.S. interest rate shocks.

Cenedese, Gino and Enrico Mallucci (2015), “What moves international stock and bond markets?”, Centre for Macroeconomics, Discussion Paper, CFM-DP2015-14, June 2015.

http://www.centreformacroeconomics.ac.uk/Discussion-Papers/2015/CFMDP2015-14-Paper.pdf

The below are excerpts from the paper. Headings and cursive text have been added.

The components of equity returns

“An unexpected increase in…[equity] returns today can be due to an increase in expected future cash flows (dividends), a downward revision of expected future excess returns (equivalently, a fall in risk premia), or both. We extend the…decomposition to an international setting…for foreign (non-U.S.) stocks into four components: [1] expected return shocks; [2] cash-flow shocks; [3] real [U.S.] interest-rate shocks; and [4] real exchange rate shocks.”

“[Theory suggests] that, other things being equal, an upward revision in forecast future dividends will have a positive impact on today’s stock return… An increase in expected future excess returns that is not accompanied by revisions in forecast dividends, interest rates and exchange rates will lead to a fall in today’s stock price so that higher future returns can be generated from the same cash flow. Similarly, positive news about future interest rates is negatively related to today’s stock prices.”

“[Empirical analysis suggests that] news about future dividends is the main sources of variation of unexpected equity returns. More specifically, the variance of dividend news is the largest component of the variance of equity returns for both advanced and emerging economies.”

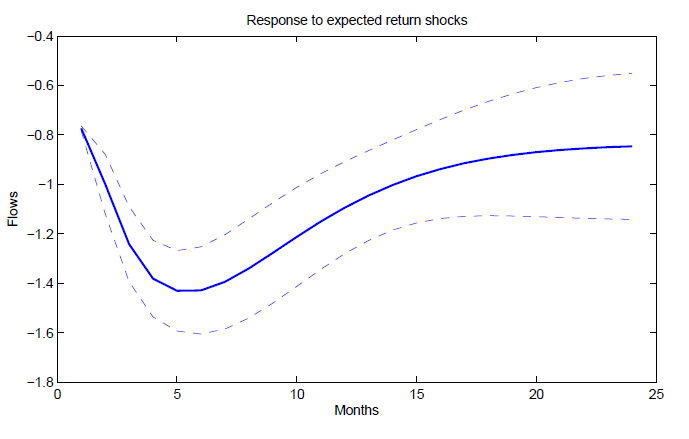

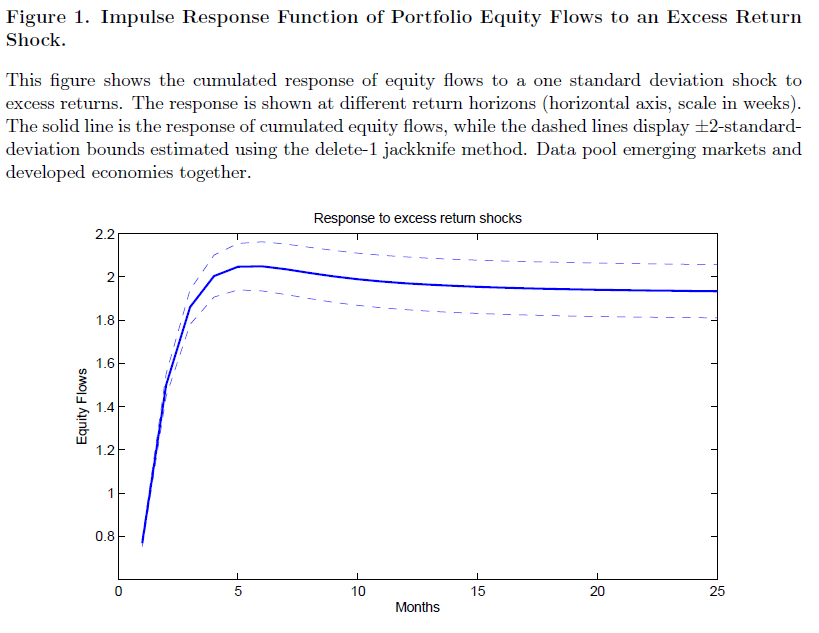

Equity return components and fund flows

“In the short run…flows react positively [to equity returns]. This is consistent with investors chasing returns and increasing their exposure to stock markets that have experienced unexpectedly high returns. However, the trend-chasing behaviour is short lived. After one quarter, the covariance between expected flows and returns turns negative… consistent with investors initially overreacting to excess return shocks and reversing some of their positions afterwards. This finding is especially strong for emerging economies….Results…are confirmed by the cumulated impulse response function [based on vector auto-regression and shown below]”

“When return shocks are driven by cash-flow news, we find evidence of a short-term trend chasing pattern in the equity market. In the long run, instead, cash-flow news is associated with equity outflows.”

“Investors are able to discriminate between appreciations that are caused by an upward revision of expected future dividend growth and excess returns that are caused by a downward revision of expected future returns [i.e. a decrease in the risk premium]. In other words, international investors are not mechanical momentum traders and they respond to a short-term transitory appreciation by selling and to a permanent appreciation by buying. The finding that flows react differently to different types of shocks is intriguing and suggests that investors behave rationally when taking investment decisions… Institutional investors behave more rationally than retail investors.”

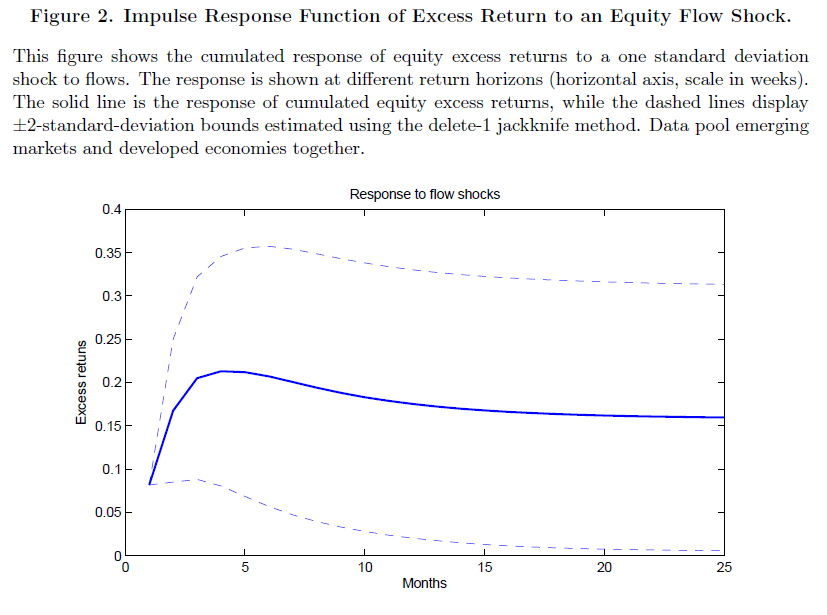

“We also investigate the existence of an anticipation effect. This is the co-movement of expected future returns and portfolio flows…Unexpected positive flow shocks are associated with an upward revision in cumulated expected future returns. Investors anticipate future returns and invest in countries that display higher expected returns. Again evidence is found that the positive relation between flows and returns breaks down in the long run…After about 5 months equity returns begin to decline.”

The components of bond returns

“The decomposition [of long-term coupon bonds] says that positive unexpected excess…returns are associated with either [1] a negative change in expected inflation rates, or [2] a decrease in expected future real interest rates or [3] excess bond returns, or [4] real exchange rates. Changes in expected inflation rates alter the expected real value of the fixed nominal payoff of the bond; even if the expected real bond returns are constant, a variation of expected inflation rates can generate capital gains or losses.”

“News about future inflation and real interest rates account for most of the variation of unexpected bond returns.”

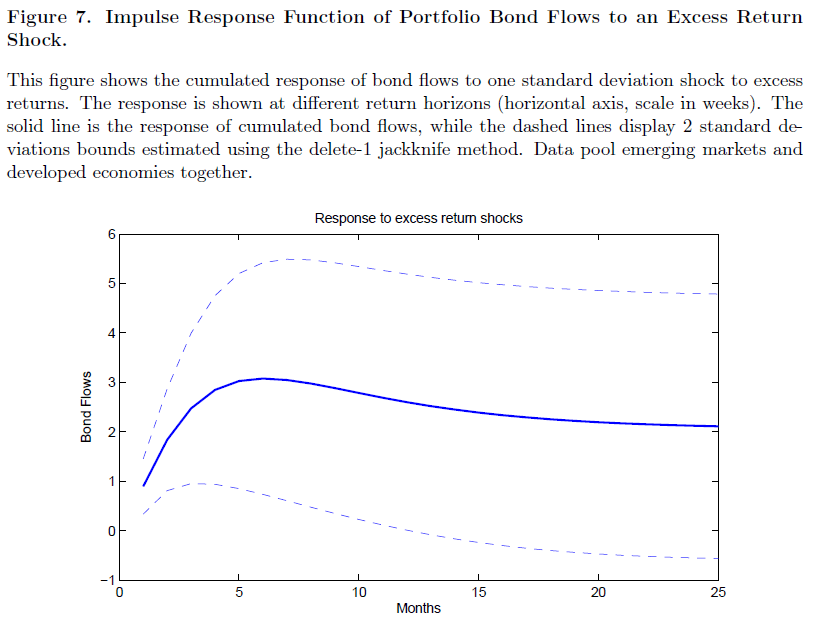

Bond return components and fund flows

“The covariance between flows and returns is positive and significant (with the exception of the developed economy sample) in the short run…The impulse response function…confirms the positive short-term impact of an excess return shock on portfolio bond flows. As the time passes, the impulse response flattens confirming the transitory nature of the relation between excess return shock and flow changes.”

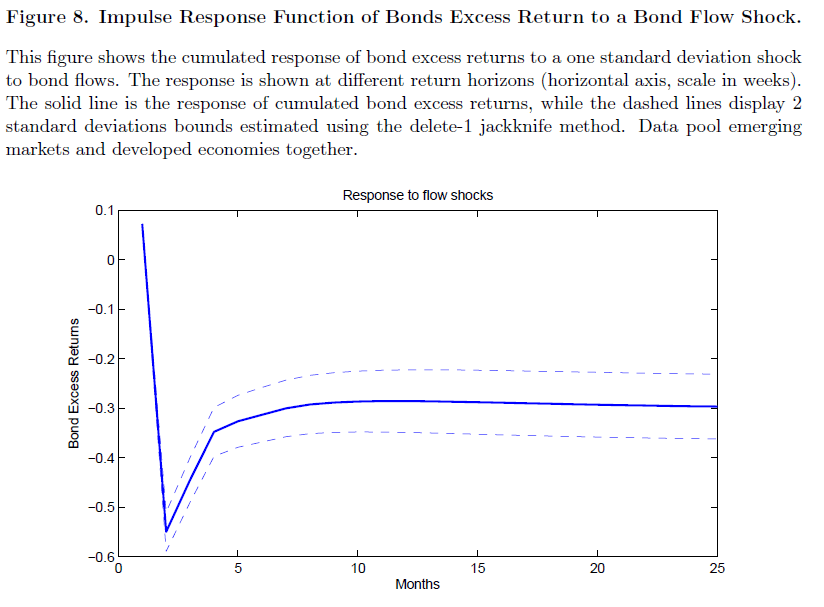

“We also assess the existence and the magnitude of an anticipation analysing co-movements between flow shocks and expected future returns. Expected returns react weakly to unexpected flow shocks in the short run…Positive flow shocks predict negative excess returns in the medium and in the long run.”

“Contrary to what we observe in the equity market, bond flows toward emerging economies are influenced by US real interest rate shocks. An upward revision of US interest rate expectations is associated with bond outflows in the short run. This result appears consistent, with the view that debt flows to emerging markets are strongly correlated with policy interventions and the business cycle of developed economies.”

Annex: Dataset used for the empirical analysis

“Our dataset covers a total of 31 countries, which we divide in two subgroups. The first subgroup is what we call the Advanced Economies group, which includes 18 countries: Austria; Belgium; Canada; Switzerland; Germany; Denmark; Spain; Finland; France; Greece; Ireland; Italy; Japan; Norway; New Zealand; Sweden; the United Kingdom; and the United States. The second subgroup is what we call the Emerging Markets group (13 countries), and which consists of Czech Republic; Hong Kong; Hungary; Indonesia; India; Mexico; Malaysia; Philippines; Russia; Singapore; South Korea; Thailand; and South Africa. For each of these countries we measure monthly equity market returns using MSCI equity index data at daily frequency obtained from Thomson Financial Datastream. We collect total return indices in US dollars. Yields on long-term coupon bonds are from Global Financial Data. Dividend yields data are also from the MSCI database. We proxy the risk-free rate with the one-month US T-bill rate….”

“Monthly fund flows data are from EPFR, which tracks portfolio flows from both institutional and retail investors into financial products such as mutual funds, ETFs, and closed-end funds. Every month, EPFR collects data from each fund manager or administrator about the fund’s total net assets, changes in net asset values, and country allocations. From these data, flows (net of redemptions) into funds are calculated.

“The resulting database contains time series running from January 2004 to December 2013.”