The BIS annual report emphasizes the dollar’s pervasive influence on international financial conditions. Post-crisis non-conventional Fed easing has spurred a global credit expansion, including economies that did not need it. Conversely, Fed tightening would reverse easy financing on a global scale, including countries that are ill prepared for it. FX depreciation is unlikely to insulate small and emerging economies from credit tightening.

Bank for International Settlements (2015), Chapter 5 of the 85th Annual Report (“The international monetary and financial system”), 28 June 2015

http://www.bis.org/publ/arpdf/ar2015e.htm

The below are excerpts from the BIS report. Headings and cursive text have been added.

The global dollar dominance

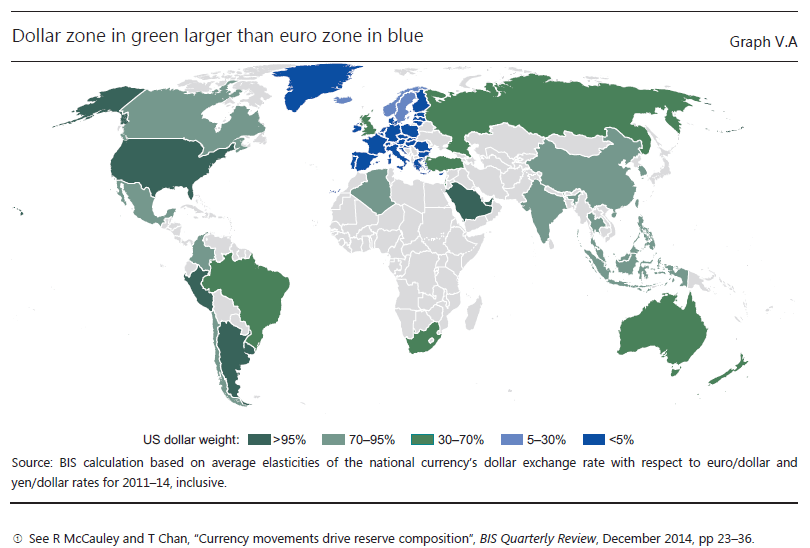

“As a means of exchange, the dollar is on one side of no less than 87% of foreign exchange market transactions…Its dominance in foreign exchange markets makes the dollar the sole intervention currency outside Europe and Japan, which supports its high share in foreign exchange reserves. More than half of world trade is invoiced and settled in dollars, pointing to the greenback’s pre-eminent role as a unit of account. Remarkably, the advent of the euro and the dollar’s trend depreciation since the 1970s have not materially challenged the dollar’s role as a store of value At 63%, it maintains almost three times the share of the euro in foreign exchange reserves. Its share in both official reserves and private portfolios is sustained by the scale of what can be termed the ‘dollar zone’ of economies whose currencies move more closely with the dollar than with the euro. At half or more of world GDP, the dollar zone is far larger than the US economy, which is less than a quarter.”

How accommodative U.S. policy translated into a global credit boom

“Monetary policies of advanced and emerging market economies have reinforced each other. Easy monetary conditions at the centre have led to easy monetary and financial conditions in the rest of the world: there, firms and governments have boosted dollar and euro borrowing and authorities have resisted unwelcome currency appreciation. In turn, their foreign exchange intervention has raised official investment in major bond markets, further compressing bond yields there.”

“In particular, dollar and euro credit to non-bank borrowers outside the United States and euro area stood at USD9.5 trillion and…USD2.7 trillion, respectively, at end-2014. The dollar debt represents a seventh of global GDP outside the United States. The large stocks of dollar- and euro-denominated credit extended to borrowers outside the United States and the euro area, respectively, mean that Federal Reserve and ECB policies are transmitted directly to other economies. The impact depends on the characteristics of the instrument in question, notably its maturity and the flexibility of the corresponding interest rate…

- In the case of bank loans priced off of dollar Libor or Euribor, changes in short-term policy rates pass through within weeks. Over half of dollar and euro credit to borrowers outside the United States and euro area remains in the form of bank loans.

- The pass-through is slower for bonds, given their generally fixed rates and longer maturity, but then quantities can respond too….Low yields…led US and global investors to seek yield in lower-quality bonds….Non- US borrowers…ramped up their dollar bond issuance… between 2009 and 2014 …by USD1.8 trillion. Investor demand for such bonds proved highly responsive to the compression of the term premium, as measured by the spread between Treasury bond yields and expected bill yields: the lower the premium, the faster the growth of dollar bonds issued by non-US borrowers.

On the structural vulnerability of local EM bond markets to international capital flows view post here.

“Resistance to appreciation has also taken the form of currency intervention, which itself feeds back into global monetary ease. Many central banks have intervened directly in the foreign exchange market, typically buying dollars, and then investing the proceeds in bonds issued by the major governments…The secular reserve accumulation and balance sheet policies of major central banks have combined to push estimated official bond holdings to more than USD12 trillion out of the USD31 trillion in US, euro area, Japanese and UK government bonds. Such holdings account for over half of the outstanding stock of US Treasury securities.”

The flaw in the international monetary and financial system

“The international monetary and financial system…today…consists of a set of domestically oriented policies in a world of largely free capital flows. Domestic monetary regimes focus mainly on price stability, while currencies are allowed to float to varying degrees…Financial regimes generally allow funds to move freely across currencies and borders…The main restraint on financial transactions takes the form of prudential regulation and supervision, in part based on internationally agreed standards.”

“The international monetary and financial system tends to heighten the risk of financial imbalances – that is, unsustainable credit and asset price booms that overstretch balance sheets and can lead to financial crises and serious macroeconomic damage. These imbalances occur simultaneously across countries, deriving strength from global monetary ease and cross-border financing. Put differently, the system exhibits ‘excess financial elasticity’: think of an elastic band that can be stretched out further but that, as a result, eventually snaps back all the more violently.”

On theoretical reason and empirical evidence for a single global financial cycle driving capital flows across a wide range of markets view post here.

The setback risk of international USD lending

“The workings of the international monetary and financial system post-crisis have spread easy monetary and financial conditions from the reserve currency areas to the rest of the world, just as they did pre-crisis. Global financial conditions have consequently loosened to an extent that may not prove consistent with lasting financial and macroeconomic stability. Credit booms in EM and some advanced economies less affected by the crisis have built up tell-tale financial imbalances.”

“The large stock of dollar debt outstanding means that a tightening of dollar credit is likely to prove consequential. Thus, renewed dollar strength could expose vulnerabilities, especially in those firms that have collectively borrowed trillions of dollars…Even in a country with a long dollar position, the distribution of currency positions across sectors matters greatly for the outcome. For example, in many EM economies the official sector has a long dollar position whereas the corporate sector carries a short one. Absent transfers from the (gaining) official sector to the (losing) corporate sector, the economy may well be hurt by dollar strength.”

“During the dollar’s downswing from 2002 to 2011 (with an interruption in late 2008), many central banks resisted unwelcome appreciation against the dollar, in setting their own policy rates and by intervening in the currency market…Dollar strength, monetary policy divergence and heavy official holdings in the global bond market could lead to volatility. Were EM economies to draw down reserves substantially, their selling bonds in the key currencies could create unprecedented cross-currents in global bond markets. ECB and Bank of Japan bond purchases, EME selling and, eventually, the Federal Reserve’s not rolling over maturing bonds could confront the remaining private investors with a difficult and shifting problem of bond pricing.”

Why flexible exchange rates do not insulate

“Exchange rate flexibility has often been described as insulating the domestic economy from external developments, but this insulation is overstated. In particular, appreciation can lead lenders to consider firms with debts denominated in foreign currency as better capitalised and therefore more creditworthy, reducing perceived risks associated with lending and increasing the availability of credit. Through this and other mechanisms, such as carry trades and momentum trading, currencies can overshoot, shrinking the traded goods sector and leaving the economy vulnerable to a turn in the ease of global financing. Then, depreciation can lead to financial distress among firms with foreign currency debt. “

Empirical analysis of USD rates effects

“[An empirical regression analysis based on] a panel of 30 emerging market and advanced economies over the period 2000–14…shows a strong relationship between changes in interest rates prevailing in these economies and changes in US interest rates, even after controlling for domestic macroeconomic conditions and the global business and financial cycle. For short-term interest rates, a 100 basis point change in US rates is associated with an average 34 basis point change in emerging market and small advanced economies. For long-term interest rates, the effect is stronger: a 100 basis point change in the US bond yield is associated with an average 59 basis point change in the yields of these economies (second column). Besides US interest rates, the degree of global investor risk aversion, as measured by the VIX, also consistently emerges as an important driver of these interest rates.”

On the growing dependence of emerging economies’ bond yields on developed market benchmarks view post here.