A new ECB paper explores macroeconomic indicators for banking and currency crises over the past 40 years. Banking crises arose mostly in constellations of [i] low credit-deposit spreads and high short-term rates (over 11%) or [iii] high credit-deposit spreads (over 270 bps) and flat or inverted yield curves. Housing price growth has also been a warning signal. Currency crises ensued from exchange rate overvaluation (more 2.7% above trend) and high short-term interest rates (over 10%).

Joy, Mark, Marek Rusnák, Kateřina Šmídková and Bořek Vašíček, (2015) “Banking and currency crises: differential diagnostics for developed countries, ECB Working Paper Series, No 1810 / June 2015 http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1810.en.pdf

The below are excerpts from paper. Headings and cursive text have been added.

A methodology for predicting crises

“We identify a set of ‘rules of thumb’ that characterize economic, financial and structural conditions preceding the onset of banking and currency crises.”

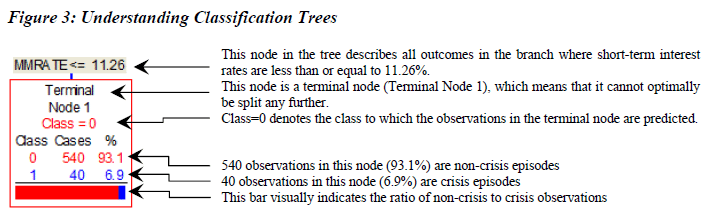

“We use Classification and Regression Tree (CART) methodology and its generalisation, Random Forest (RF) analysis, to model…non-linear interactions between variables…[and] provide crisis thresholds for key variables…Unlike the previous regression-based methods it looks for non-linear and conditional relations between crisis triggers.”

“CART is able to tell the policymaker…the specific conditions…[under which] certain crisis indicators are more reliable than others…CART helps us to identify, for instance, that while rapid house price inflation is a good predictor of banking crises 2–3 years ahead, banking crises can also be consistent with sluggish house price growth, if short-term interest rates are low and the yield curve flat.”

“We apply the CART and RF techniques on an unbalanced panel dataset consisting of 36…countries between 1970 and 2010. We investigate what macroeconomic, financial and structural conditions prevailed in the economies in the periods ahead of banking and currency crises in this period.”

Indicators of banking crises

“We find that a high net interest rate spread in the banking sector (i.e. the spread between the loan and deposit rate) combined with a flat or inverted yield curve are the most reliable indicators of banking crises one-to-two years ahead of a crisis; we interpret this as evidence in favour of the hypothesis… that the term spread can be thought of as representing the marginal profitability of bank lending, and compression of the term spread, at the peak of a banking boom, can be a causal signal of bust.”

“Our baseline tree for banking crises is shown in [the graph below]…Banks’ net interest rate spread emerges as the main splitter at the top of the tree (Node 1), with an estimated threshold value of 2.7%…The short-term interest rate is on the main left branch of the tree, with a relatively high estimated threshold of 11.26%. Our estimates suggest that when banking sector net interest rate spreads are low and short-term interest rates are high, the probability of a banking crisis 4–8 quarters ahead is 22%….Following the main right branch of the tree…relatively high short-term interest rates (> 3.95%, Terminal Node 5) coupled with a flat or inverted yield curve seem to represent a significant risk of a banking crisis. For example, in the early 1980s, when the US yield curve inverted, savings and loan associations there were forced to pay sharply higher rates to depositors than they were receiving on their own assets, which consisted mainly of long-term, fixed-rate mortgages. The result was America’s savings and loans crisis, with nearly 4,000 institutions driven into insolvency.”

“Two-to-three years ahead of a banking crisis, house prices seem to be the most important predictor of crisis onset.”

“For banking crises, we find that both country structural characteristics and international developments are relevant crisis predictors…Specifically, when the yield curve is shallow there are two combinations of structural characteristics that make the economies more vulnerable. First and foremost is the combination of high economic openness (in terms of trade as a share of GDP) and a high degree of financial development (in terms of financial depth)… Second, when trade openness is below the estimated threshold of 94.6%, industry share becomes [relevant].”

Indicators of currency crises

“As for currency crises, the most powerful predictor one-to-two years ahead is exchange rate overvaluation combined with high domestic short-term interest rates…the episodes of currency crises in our sample of advanced countries were very rare (we have only six currency crises as opposed to approximately 30 episodes of banking crisis).”

“Short-term interest rates are the main determining factor. The estimated threshold value of the short-term interest rate is 10.4% and all currency crises were preceded by short-term rates exceeding this relatively high threshold (Node 2). The deviation of the nominal effective exchange rate from its trend (the deviation from the Hodrick–Prescott trend) is the next main splitter (a threshold of 2.7%). Terminal Node 3 shows that most currency crises occurred following high domestic short-term interest rates coupled with overvaluation of the domestic currency (i.e. significantly above its trend value).16 It might.”

“The presence of high short-term interest rates as a crisis predictor is apparent for both banking crises and currency crises. Comparing the crisis episodes under these nodes, we find four candidates for twin currency and banking crises…First, the banking crisis in the UK that started in 1991Q1 and lasted until 1995Q2 (the UK’s “small banks crisis”) overlapped with a currency crisis later between 1992Q4 and 1993Q1.17 Second, for Italy, the currency crisis that hit the lira in 1992Q3 was followed by a banking crisis in 1994–1995. Third, in South Korea we find that a banking crisis starting in early 1997 was followed by a currency crisis in 1998. Fourth, the same pattern (as for the UK and South Korea) can be found in Turkey, where the outbreak of a banking crisis in 2000Q4 was almost immediately followed by a currency crisis in 2001Q1, both terminating at the same time in late 2001.”

“For currency crises, predictors are largely idiosyncratic to the country and of a short-term (rather than structural) nature.”