A new BIS paper summarizes motives and impact of FX interventions. Most importantly it looks at the conditions under which such interventions are effective (and hence likely). The strongest case for interventions arises when [i] the central bank has a clear view about an exchange rate misalignment, and [ii] the intervention would not go against the interest rate differential.

Chutasripanich, Nuttathum and James Yetman, “Foreign exchange intervention: strategies and effectiveness”, BIS Working Papers No 499, March 2015

http://www.bis.org/publ/work499.pdf

The below are excerpts from the paper. Emphasis and cursive text have been added.

On the impact of FX interventions on currency misalignments and external imbalances view post here.

On the (typically unintended) expansionary effect of sterilized FX purchases by central banks on the local financial system view post here.

On the limited effect of FX interventions on exchange rate expectations of analysts view post here.

The motives for FX interventions

“The motives of the central banks’ activities [in the FX markets]… can be grouped as follows:

- Leaning against the wind: According to the recent BIS survey of central banks, the most common reason cited for emerging market central banks to intervene in foreign exchange markets was to limit exchange rate volatility and smooth the trend path of the exchange rate…

- Reducing exchange rate misalignment: Too high an exchange rate can reduce a country’s competitiveness, and too low can lead to an unsustainable growth spurt and inflation. Therefore, central banks…step into the foreign exchange market if they see that the current exchange rate appears to be either overvalued or undervalued…

- Managing…FX reserves: After the Asian financial crisis, many central banks accumulated reserves. The crisis focused the spotlight on the precautionary motive for holding reserves, and their insurance value in the face of currency pressures… Around 50% of central banks intervening in foreign exchange markets during 2004-2010 were motivated at least in part by the desire to accumulate reserves…

- Ensuring liquidity: Owing to shallow foreign exchange markets, some central banks may conduct intervention to ensure adequate liquidity in order to counter disorderly markets and avoid financial stress…The recent BIS survey shows that, during the international financial crisis, more than half of participating central banks intervened to provide liquidity.”

“Surveys of central banks are generally supportive of intervention effectiveness. For example, around 70% of participating central banks believe that their intervention during the 2005-2012 period was successful… [According to survey opinion] central bank intervention has a temporary effect on exchange rates.”

The influence of interventions on markets

“Central bank intervention in foreign exchange markets may influence exchange rates, and the wider economy, via…different channels:

- Portfolio-balance channel: If the central bank, as a major market player, influences the supply or demand of financial assets through its own trading activities, this is likely to result in other market participants rebalancing their financial asset portfolios.

- Signaling (or expectations) channel: This channel works through the adjustment of expectations about future central bank policy. A highly-publicised transaction in foreign exchange markets may be interpreted as setting a precedent for future interventions, or revealing information about the level of the exchange rate that is considered desirable by policymakers

- Order-flow channel: This is based on the idea that the central bank has superior information to other market participants… This information advantage may then be used to the central bank’s advantage to shape the market.”

A model analysis of FX interventions

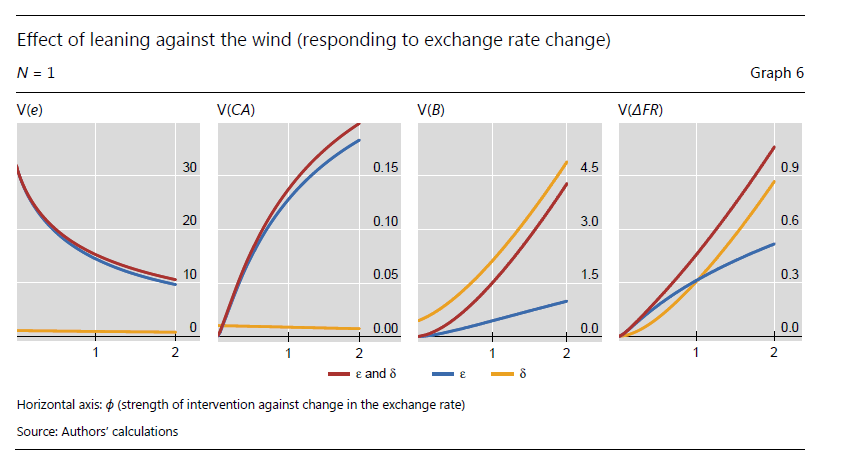

“We examine two intervention rules – leaning against exchange rate misalignment and leaning against the wind – utilised with varying degrees of transparency…We assess the effectiveness of these rules against five criteria: stabilising the exchange rate, reducing current account imbalances, discouraging speculation, minimising reserves volatility and limiting intervention costs. “

“In our model…we allow for three types of agents: real activity traders, speculators and the central bank…The central bank will observe the overall effect of other transactions in the market place on the exchange rate and use this to determine their own intervention strategy.”

“Central banks are assumed to intervene in foreign exchange markets by changing the size of their shock of foreign exchange reserves.… intervention is fully sterilised.”

The effectiveness of interventions

“The effect of intervention policy intended to reduce the misalignment of the exchange rate from its fundamental value… is generally successful, in the sense that exchange rate deviations from their fundamental value decline as the strength of the intervention response increases.”

“For the case of only interest rate shocks, however, intervention is less effective. On the surface it appears to be successful: the misalignment of the exchange rate declines, and further the more strongly the central bank intervenes. But this comes at a price…There is a feedback-loop here: intervention reduces the volatility of the exchange rate, which encourages more speculation, which drives the exchange rate further from its fundamental value, which increases the size of the central bank intervention, and so on. The end result is that foreign exchange reserves are very volatile.”

“Plausibly, the central bank may know the direction that the fundamental value of the exchange rate has changed in response to a shock, but is unlikely to know the magnitude of the change with any degree of precision…Central bank uncertainty about the fundamental value of the exchange rate results in foreign exchange intervention being less efficient; beyond some level of uncertainty, intervention is generally destabilising.”

“Foreign exchange intervention that is intended to reduce the volatility of the exchange rate [leaning against the wind] has a negative side-effect. To the extent that it succeeds, it also reduces the volatility faced by speculators and therefore improves their risk-return trade-off, encouraging them to take larger speculative positions, which tend to be destabilising.”

The costs of interventions

“Another dimension of intervention…is the cost of sterilised intervention. Many central banks in emerging market economies have seen a steady accumulation of reserves as a result of foreign exchange intervention, and the carrying costs and exchange rate risks of these can be considerable:”

“The expected cost of reserves holdings depends critically on the intervention strategy and the nature of shocks that the economy is subject to… A small amount of leaning against the wind generates a profit for the central bank. But, beyond a certain level, this turns into a cost if interest rate shocks drive the exchange rate process. In contrast, responding to deviations from the fundamental value of the exchange rate is never profitable.”

“The costs of foreign exchange intervention will be especially large when exchange rate movements are driven by shocks to the differential between home and foreign interest rates since these drive a positive correlation between the stock of reserves and the carrying costs of those reserves… a negative interest rate differential attracts speculative inflows and causes the exchange rate to appreciate. In response, regardless of which of the two strategies it is following, the central bank will be induced to intervene to stave off the appreciation of the currency. Thus the rate of accumulation of foreign exchange reserves will be larger the more negative is the interest rate differential. But, given that the (negative of the) interest rate differential is also the carry costs per unit of foreign exchange reserves, there will be a positive correlation between the strength of the central bank’s intervention and the costs to the central bank.”