A Chicago Fed paper argues that economic uncertainty at the zero lower bound (ZLB) should be a cause of looser monetary policy. This is basic risk management, as confirmed by Fed Chair Janet Yellen. Near the ZLB unduly tight monetary policy is more difficult to correct than unduly easy policy. Moreover, the mere risk of being constrained by the ZLB tomorrow affects expectations already today and can reinforce the severity of the ZLB constraint.

Evans, Charles, Jonas Fisher, Francois Gourio and Spencer Krane (2015), “Risk Management for Monetary Policy Near the Zero Lower Bound”, Brookings Papers on Economic Activity, BPEA Conference Draft, March 19–20, 2015 http://www.brookings.edu/about/projects/bpea/papers/2015/risk-management-monetary-policy-zero-lower-bound

Also see Yellen, Janet, “Normalizing Monetary Policy: Prospects and Perspectives”, Remarks at “The New Normal Monetary Policy,” a research conference sponsored by the Federal Reserve Bank of San Francisco, March 27, 2015. http://www.federalreserve.gov/newsevents/speech/yellen20150327a.htm

The below are excerpts from the paper. Emphasis and cursive text have been added.

“We demonstrate that the zero lower bound [ZLB] on nominal interest rates implies that the central bank should adopt a looser policy when there is uncertainty.”

Why policy risk is asymmetric at the ZLB

“On the one hand, raising rates early might lead to excessively weak growth and inflation if the economic fundamentals turn out weaker than expected. On the other hand, raising rates later might lead to inflation if economic fundamentals are stronger than expected. Near the zero lower bound, monetary policy tools are strongly asymmetric and can deal with the second scenario much more easily than with the first.”

“The implications of the ZLB for the attainment of the FOMC’s policy goals are severe. It is true the FOMC has access to unconventional policy tools at the ZLB, but these appear to be imperfect substitutes for the traditional funds rate instrument. Furthermore, there is no guarantee that they will be as successfully as they have in the past if monetary policy tightened and then the economy were to soon return to the ZLB, in part because the credibility that supported the alternative tools prior efficacy could be substantially diminished by an unduly hasty exit from the ZLB.”

“In contrast, it is reasonable to imagine that the costs of inflation running moderately above target for a while are much smaller than the costs of falling back into the ZLB. This is not the least because it is likely that inflation could be brought back into check with modest increases in interest rates.”

Yellen: “A…reason for the Committee to proceed cautiously in removing policy accommodation relates to asymmetries in the effectiveness of monetary policy in the vicinity of the zero lower bound. In the event that growth in employment and overall activity proves unexpectedly robust and inflation moves significantly above our 2 percent objective, the FOMC can and will raise interest rates as needed to rein in inflation. But if growth was to falter and inflation was to fall yet further, the effective lower bound on nominal interest rates could limit the Committee’s ability to provide the needed degree of accommodation. With an already large balance sheet, for example, the FOMC might be concerned about potential costs and risks associated with further asset purchases.”

Why risk management is crucial at the ZLB

“In practice, policymakers are sensitive to uncertainty and respond by following what appears to be a risk management approach… when a policymaker might be constrained by the ZLB in the future, optimal policy today should take account of uncertainty about fundamentals… Higher uncertainty, i.e. a mean-preserving spread, in the distribution of the natural rate tomorrow…leads to a looser policy today.”

“Our main theoretical contribution is to provide a simple demonstration that within the canonical framework [where a central bank sets the interest rate to minimize inflation and output gaps]…the ZLB implies a new role for such risk management through two distinct economic channels.

- The first channel – which we call the expectations channel – arises because the possibility of a binding ZLB tomorrow leads to lower expected inflation and output today and hence requires some counteracting policy easing today… A low output gap tomorrow depresses output today by a wealth effect…and depresses inflation today…Low inflation tomorrow depresses inflation since price setting is forward looking…and depresses output today by raising the real interest rate.

- The second channel, which we call the buffer stock channel, arises because…it can be optimal to build up output or inflation today in order to reduce the likelihood and severity of being constrained by the ZLB tomorrow… The buffer stock channel does not rely on forward-looking behavior, but rather on the view that the economy has some inherent momentum, e.g. due to adaptive inflation expectations, inflation indexation, habit persistence, adjustment costs and hysteresis… [it] is similar to the forward-looking model solution…except that optimal policy now takes into account the cost of having inflation away from target tomorrow.”Yellen: “Research suggests that, the higher the probability of monetary policy becoming constrained by the zero lower bound in the near future because of adverse shocks, and the more severe the attendant consequences for real activity and inflation, the more current policy should lean in accommodative direction. In effect, such a strategy represents insurance against the zero lower bound by aiming for somewhat stronger real activity and a faster rise in inflation under the modal outlook.”

- “The buffer stock channel and the expectations channel have very similar policy implications but for very different reasons. The expectations channel involves the possibility of being constrained by the ZLB tomorrow feeding backward to looser policy today. The buffer stock channel has looser policy today feeding forward to reduce the likelihood and severity of being at the ZLB tomorrow.”

Risk management practice at the FOMC

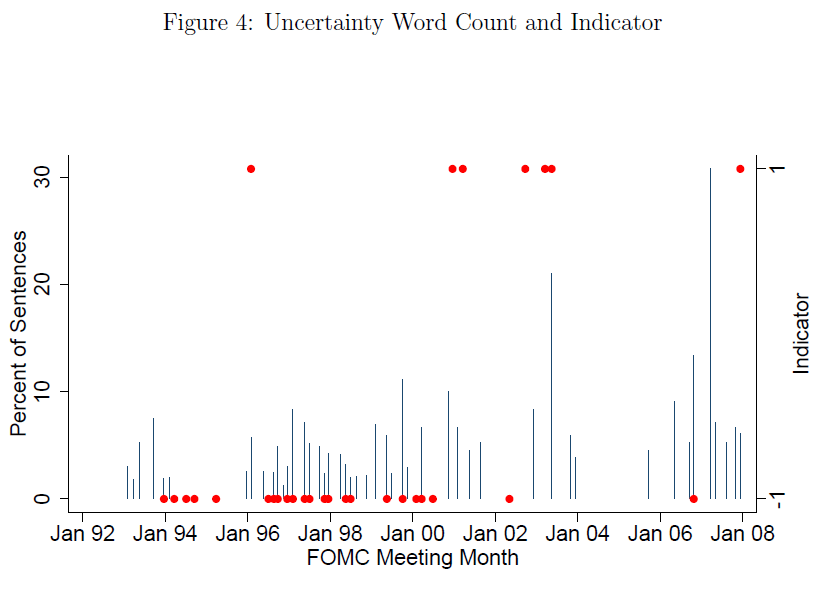

“In practice, policymakers are sensitive to uncertainty and respond by following what appears to be a risk management….The FOMC’s historical policy record provides many examples of how risk management considerations likely have influenced monetary policy decisions.”

“The record [minutes and communications]…indicates several instances when the Committee said its policy stance was taken in part as insurance against undesirable outcomes; during these times, the FOMC also usually noted reasons why the potential costs of a policy overreaction likely were modest as compared with the scenario it was insuring against. And there are a few instances when the Committee appears to be reacting to head off a potential change in dynamics that might accelerate the economy into a serious recession. Two episodes are particularly revealing. The first is the hesitancy of the Committee to raise rates in 1997 and 1998 to counter inflationary threats because of the uncertainty generated by the Asian financial crisis and subsequent rate cuts following the Russian default. The second is the loosening of policy over 2000 and 2001, when uncertainty over the degree to which growth was slowing and the desire to insure against downside risks appeared to influence policy.”