A BIS paper shows significant positive correlation of implied FX volatility and local EM bond yields. Empirically the causality runs mostly from FX to bonds, probably because currency risk is a key factor of foreign bond holdings. However, there can also be reverse causality, when FX derivatives are used as proxy hedge in a bond market turmoil. Since FX volatility is stationary, extreme values can indicate value in local EM bonds.

Gadanecz, Blaise, Ken Miyajima, Chang Shu, (2014), “Exchange rate risk and local currency sovereign bond yields in emerging markets”, BIS Working Papers, No. 474, December 2014

http://www.bis.org/publ/work474.pdf

The below are excerpts from the paper. Emphasis and cursive text have been added.

Non-FX factors of local EM bond yields

“Drivers of bond yields include country-specific factors, international factors common to all EMEs, and investor risk preferences. Country-specific factors comprise changes in domestic interest rates, inflation, as well as sovereign credit risk relative to major currency areas and other EMEs. International factors include interest rates in major currency areas, external shocks and changes in international investors’ risk preferences that can affect exchange rate movements across EMEs as a group…The relative importance of domestic and international factors may have changed as EMEs have become increasingly integrated into the global economy and financial markets.”

Theory on the relation between local EM yields and FX risk

“One view…is that causality runs from exchange rate risk to local-currency sovereign yields…Exchange rate risk can be important for EME local currency government bond yields for several reasons.

- First, investors are exposed to exchange rate risk on their bond positions. Perceived changes in exchange rate risk can therefore move local currency bond yields.

- Second, large currency mismatches in corporate, banking or household sector balance sheets in EMEs increase default risks for local currency sovereign bonds.

- Third, a perception of greater exchange rate risk can reduce liquidity in foreign exchange and domestic bond markets.”

“Another view is that changes in bond yields drive exchange rate movements. In many EMEs, the foreign exchange market is often more liquid than the local currency bond market, and foreign investors may use foreign exchange as a proxy hedge for their local currency bond exposures. Because these investors adjust their foreign exchange hedging based on bond performance, movements in local currency sovereign bond yields influence exchange rate movements, even though exchange rate risk and duration risk are different in nature.”

Evidence on the relation between EM yields and FX risk

“We consider additional measures of exchange rate risk – in particular…implied exchange rate volatility…Simple regression analysis… for the period of January 2012–June 2014…broadly confirms the view that exchange rate risk assumed a greater role during the recent period of market volatility. As local currency sovereign bond yields declined during January 2012–April 2013, a one percentage point increase in exchange rate volatility…was associated with a little over 2 basis point increase in yields. The sensitivity surged to over 4 basis points during May/June 2013, and to 5 basis points in the subsequent period.”

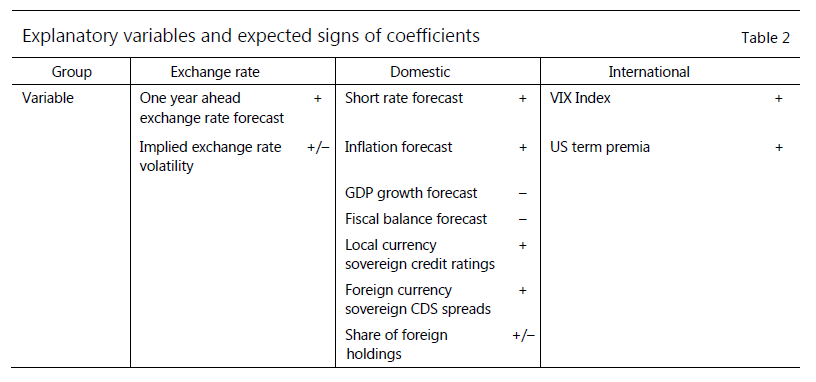

“To formally model local currency sovereign bond yields, we…rely on a panel fixed effects regression. For the dependent variable…we use the five-year local currency sovereign bond yield for 20 major EMEs. We use monthly data spanning from January 2005 to December 2013…The explanatory variables are [i] exchange rate factors, [ii] domestic factors (specific to each EME)…[iii] international factors (common to all EMEs).”

“The estimation results…suggest that exchange rate risk (proxied by the implied volatility of the exchange rate) positively and significantly affects local currency bond yields. This finding holds even after controlling for exchange rate forecasts, domestic factors, international factors or both… A one percentage point increase in implied exchange rate volatility [which usually is in a range of 2-40% annualized for EM currencies] is associated with a 4–7 basis point rise in local currency bond yields.”

“Bivariate Wald tests…confirm that for a majority of EMEs in our sample, the direction of the causality goes from exchange rate volatility to local currency sovereign bond yields. This is especially the case in Asia and eastern Europe. In these two regions, local currency sovereign bond markets are relatively liquid and foreign participation relatively large (for the period of 2005–13, foreigners held 10% of total local currency sovereign bonds outstanding on average in Asia, and 20% in eastern Europe).”

“Exchange rate volatility remains a statistically significant determinant of local currency sovereign yields regardless of the monetary policy framework. The coefficient on implied exchange rate volatility…is however somewhat larger in less flexible exchange rate regimes. One interpretation is that…if the credibility of a fixed exchange rate is questioned, a given exchange rate fluctuation could result in a larger market reaction than when the exchange rate fluctuates under a floating regime by the same amount.”