Market liquidity accommodates securities transactions in size and at low cost. When it fails the information value of market quotes is compromised, potentially triggering feedback loops, margin calls and fire sales. With shrinking market making capacity at banks, the fragility of liquidity in both developed and emerging markets has probably increased. The rise of larger and more pro-cyclical buy-side institutions seems to enhance this vulnerability.

IMF Global Financial Stability Report, October 2015, Chapter 2, “Market Liquidity – Resilient of Fleeting?”

http://www.imf.org/External/Pubs/FT/GFSR/2015/02/index.htm

The below are excerpts from the report. Headings, links and cursive text have been added.

What is market liquidity?

“Market liquidity is the ability to rapidly execute sizable securities transactions at a low cost and with a limited price impact…An intermediary makes a market in a security when it stands ready to sell the instrument at the announced ‘ask’ price and buy it at the announced ‘bid’ price. Market making requires sufficient inventories of the security and large risk-bearing capacity.”

“Market liquidity is different from the notions of funding liquidity (the ability by market participants to obtain funding at acceptable conditions) and monetary liquidity (typically used in relation to monetary aggregates)….Despite their differences, these…concepts are related. Funding liquidity…is typically a prerequisite for market liquidity, since market makers also use credit to maintain inventories. Market liquidity, for its part, tends to enhance funding liquidity because margin requirements depend on the ease with which securities can be sold.”

“Two aspects of market liquidity must be considered: its level and its resilience. Low levels of liquidity may foretell low resistance to shocks. But measures of the level in normal times may be insufficient to assess the risk that a shock will produce if liquidity ‘freezes.’ A well-known characteristic of market liquidity is that it can suddenly disappear during periods of market stress.”

Liquidity risk refers to the probability that security transaction costs surge when trading is required. On the basics of market liquidity risk view post here.

Why is market liquidity a systemic concern?

“Market liquidity that is low is …likely to be fragile…prone to evaporation in response to shocks. When liquidity drops sharply, prices become less informative and less aligned with fundamentals, and tend to overreact, leading to increased volatility. In extreme conditions, markets can freeze altogether, with systemic repercussions.”

“Market liquidity can be severely impaired as a result of asset price drops, margin calls, and induced fire sales and liquidity feedback loops. Similarly, liquidity contagion across markets can occur…Bond prices strongly affect…macroeconomic stability through interest rate and wealth effects. Bond prices also affect financial stability through their pivotal role in the repo market and their connection to funding liquidity.”

Government and other investment grade bonds are the main form of collateral in the financial system. On the relation between collateral values and liquidity view post here.

What are the drivers of market liquidity?

“The drivers of market liquidity levels and resilience comprise three broad categories…

- the risk appetite, funding constraints, and market risks faced by financial intermediaries, all of which affect their inclination to provide liquidity services and correct the mispricing of assets;

- search costs, which influence the speed with which buyers and sellers can find each other; and

- investor characteristics and behavior reflecting different mandates, constraints, and access to information.”

“Although common factors may play a role in the co-movement of liquidity across asset classes, shocks often propagate from the investment-grade bond market to other markets. Statistical analysis…suggests that liquidity shocks to investment-grade bonds significantly affect liquidity in other asset classes but that those bonds’ liquidity is not much affected by that of other classes.”

Why have concerns over market liquidity increased?

“Concerns about both a decline in current market liquidity… and its resilience have risen… Market participants in both advanced and emerging market economies have been expressing worries about a perceived decline in liquidity…

- Reductions in market making appear to have harmed market liquidity… As banks have been changing their business models and shrinking their inventories, market-making services seem to have become concentrated in fewer clients. In addition, regulations requiring banks to increase capital buffers and restrictions on proprietary trading may have led them to retrench from trading and market-making activities… Evidence from the U.S. bond market indicates that when inventories at dealers are low or when dealers’ ability to make markets is impaired, aggregate liquidity is more likely to drop sharply.

- Another key development has been the rise of larger but more homogeneous buy-side institutions, particularly investment funds… The growing role in bond markets of mutual funds that offer daily redemptions to retail investors, coupled with signs of increasing herding and concentration among market participants, has made market liquidity more vulnerable to rapid changes in sentiment…At the same time, the proliferation of small bond issuances has likely lowered liquidity in the bond market and helped build up liquidity mismatches in investment funds…

- The behavior of hedge funds has become more comparable to that of mutual funds…

- The growth of index investors and the more widespread use of benchmarks are likely to have increased commonality in liquidity and thereby systemic liquidity risk.”

On increasing bond market liquidity risks also view post here.

What are current liquidity trends?

“The October 2014 Treasury bond flash rally in the United States, or the April 2015 Bund tantrum in Europe, have reminded us…that market dislocations can occur even for some of the most liquid assets.”

On recent liquidity events and explanations also view post here.

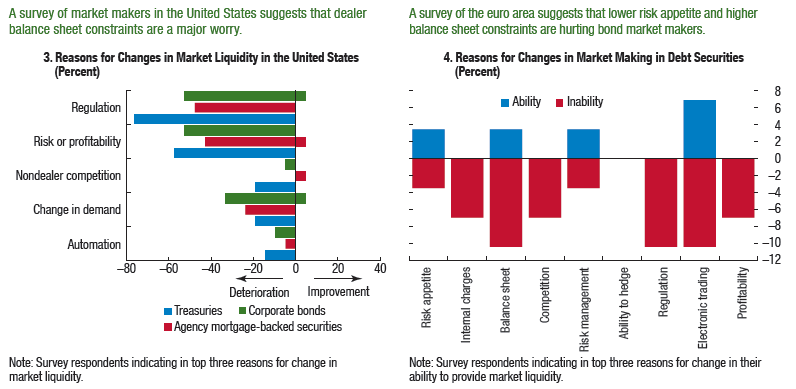

“Dealer banks in advanced economies show signs of being less active market makers in fixed-income securities. In several advanced economies, bank holdings of corporate debt have declined amid a large increase in total outstanding debt… In addition, surveys by the Federal Reserve and the European Central Bank (ECB) suggest that market making has declined, mostly because of bank balance sheet constraints, internal charges to market making and trading, and regulatory reforms.”

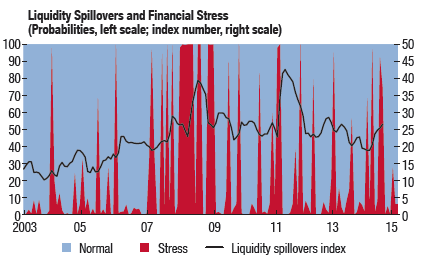

“Overall, current levels of market liquidity do not seem alarmingly low, but underlying risks are masked by unusually benign cyclical factors…Current liquidity levels partly reflect important cyclical drivers of liquidity, monetary accommodation, and risk appetite that are in a supportive phase… When the cyclical factors at some point reverse—most likely in conjunction with the normalization of monetary policies in advanced economies—the resulting exposure to the underlying fragilities can produce a sudden deterioration in market liquidity and an increase in liquidity spillovers across asset classes. “