Empirical analyses document the success of trend following strategies in global equity and FX markets over the past 30 years. Stylized trend following delivered higher risk-adjusted returns with smaller maximum drawdowns when compared with other conventional strategies. It also provided value as a hedging strategy.

Clare Andrew, James Seaton, Peter N. Smith and Stephen Thomas (2015a), “Size Matters: Tail Risk, Momentum and Trend Following in International Equity Portfolios”, University of York, Discussion papers in Economics, No. 15/06 http://www.york.ac.uk/media/economics/documents/discussionpapers/2015/1506.pdf

Clare Andrew, James Seaton, Peter N. Smith and Stephen Thomas (2015a), “Carry and Trend Following Returns in the Foreign Exchange Market”, University of York, Discussion papers in Economics, No. 15/07

http://www.york.ac.uk/media/economics/documents/discussionpapers/2015/1507.pdf

The below are excerpts from the papers. Headings and cursive text have been added.

The definition of momentum and trend following strategies

“Typical momentum strategies involve ranking assets based on their past return (often the previous twelve months) and then buying the winners and selling the losers.”

“A…type of momentum investing is where one is interested only in the direction of prices or returns rather than how they fair against their peer group. This type of activity is known as trend following (…absolute momentum) and is frequently used by Commodity Trading Advisors (CTAs). As examples, trend following rules may use the current price relative to a moving average or the length of time that excess returns have been positive over a range of time frames. The aim is always to trade in the direction of the prevailing price, i.e. when prices are rising long positions are taken and when prices are falling then cash or short positions are taken.”

“Trend following has been widely used in futures markets, particularly commodities, for many decades… Hurst et al (2012) demonstrate that trend following has been a profitable strategy to adopt across equities, bonds, currencies and commodities as far back as 1902..Trading signals can be generated by a variety of methods such as moving average crossovers and breakouts with the aim to determine the trend in prices.”

The rationale behind trend following

“As trend following is generally rules-based it can aid investors since losses are mechanically cut short and winners left to run. This is frequently the reverse of investors’ natural instincts [and hence protects the investment process against actions that are motivated by fear and stress as opposed to return optimization].”

“A variety of explanations [are offered] as to why trend-following may have been successful historically, including investor underreaction to news and herding behaviour.”

On changes in expectations and ensuing price trends view post here.

On the causes and consequences of herding view posts here and here.

“The intuition behind the simple trend following approach is that while current market price is most certainly the most relevant data point, it is less certain whether the most appropriate comparison is a month or a year ago. Taking a moving average therefore dilutes the significance of any particular observation.”

Evidence for value in equity price trend following

“In order to gauge the impact of both momentum and trend following on market cap investment strategies, we used MSCI Large, Mid and Small Cap indices for 20 developed and 12 developing economies…Monthly data for these price and total return indices begins from the end of May 1994 for the large and mid-cap indices and from the end of December 2000 for the small cap indices unless otherwise indicated. The final month for all data is May 2013.”

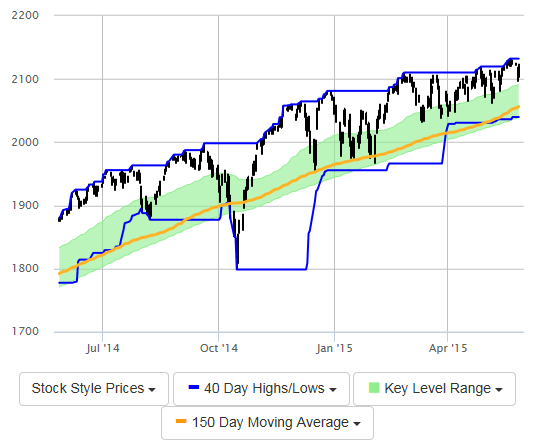

“We…use a 10-month moving average to define the trend. Specifically, if the current index price is above a simple 10-month moving average of the prices then a long position in the asset is adopted.”

“The introduction of trend following…[to equally-weighted international equity portfolios] was observed to offer substantial benefits across all size categories and both developed and emerging markets. Annualized returns were typically slightly higher but the big gains were made in considerably lower volatility and maximum drawdowns compared to relative momentum and buy-and-hold portfolios… A further benefit to the trend following approach is that maximum drawdowns are reduced from around 60% to close to 20% in all portfolios. Finally, we also find that portfolios become less negatively skewed. In the case of developed markets these remain negative, however, the emerging markets and the portfolios.

On previous evidence for the success of trend following in the U.S. equity market view post here.

Comparison of equity trend following with relative momentum

“When relative momentum was introduced we found that over the whole period there were some small risk-adjusted gains to be had. These appeared to diminish after 2001, however, when there became little difference with base case portfolios.”

“We combined relative momentum and trend following strategies together. We observed that the level of return was higher than trend following alone but that this was accompanied by a commensurate increase in volatility such that risk-adjusted returns were, on aggregate, little changed. We thus conclude that trend following is the dominant momentum effect.”

Trend following in FX markets

“The returns that we examine are for 39 currencies measured against the US dollar…This set of currencies includes a broad range of developed and developing country exchange rates… For each currency the data are monthly, measured on the last trading day of the month for the period January 1981 – December 2013… The number of currencies included varies over time.”

“We consider a trend following rule that is popular with investors which is based on simple monthly moving averages of returns. The buy signal occurs when the individual currency return moves above its average where we consider moving averages ranging from 4 to 12 months.”

“Zero net investment strategies that buy those currencies displaying a positive trend and sell those with a negative trend show high average returns and Sharpe Ratios with essentially no skewness and modest maximum drawdown. Overall, the trend following strategies based on moving averages between 4 and 12 months generate rather similar outcomes… the alpha is highly significant and that none of the conventional risk factors can explain the trend following results

Trend following and FX carry trade

“The literature on the [FX] carry trade has examined a wide range of possible risk and non-risk based explanations for the size and time series behaviour of carry returns. The key features are a significant high and persistent average return but one which displays significant negative skewness.”

“Market betas conditional on market liquidity can price a cross-section of currency returns and provide an explanation for the excess return on the carry trade… trend following offers a simple hedge for the risks that are priced by the carry trade whilst generating a significant unexplained average return of a similar order to magnitude to that offered by carry. Thus, when combined with a trend following overlay, the combined strategy generates an average return well above that of the individual components. This increased average return also has desirable characteristics in terms of higher moments; it offers a higher Sharpe ratio and positive skewness as well as a smaller maximum drawdown than the components or alternative strategies.”