A recent IMF paper suggests that sizeable negative policy rates could be implemented in developed economies. The key would be a variable deposit fee at the central bank cash window that can enforce value decay of paper currency relative to electronic money. Despite legal and economic issues, the proposal is disconcertingly practical in light of the expansion of electronic payments. Its mere consideration would be a tail risk for fixed income markets.

Agarwal, Ruchir and Miles Kimball (2015), “Breaking Through the Zero Lower Bound”, IMF Working Paper 15/224, October 2015.

http://www.imf.org/external/pubs/cat/longres.aspx?sk=43358

The below are excerpts from the IMF paper. Headings, links and cursive text have been added.

The zero lower bound for interest rates

“The zero lower bound arises when a government issues pieces of paper (or coins) guaranteeing a zero nominal interest rate, over all horizons, that can be obtained in unlimited quantities in exchange for money in the bank. This acts as an interest rate floor, making people unwilling to lend at significantly lower rates….While storage of paper currency can be driven underground, it is hard to fully prevent.”

“The zero lower bound is a policy choice, not a law of nature”

Electronic money and paper currency deposit fee

“The combination of (a) using electronic money as the unit of account and (b) a time-varying paper currency deposit fee can be used to eliminate the option to circumvent the negative rates by withdrawing, storing and, later, redepositing paper currency…Since electronic money provides the unit of account, ‘nominal’ means relative to an electronic dollar, euro, pound, or yen, and not relative to a paper dollar, euro, pound, or yen.”

“The key idea is that a negative interest rate can be accompanied by a time-varying deposit fee that ensures the value of paper money and the value of funds in electronic accounts will move in tandem. Such a deposit fee only needs to be imposed at the central bank’s cash window—the facility through which the central bank and commercial banks interact to bring cash in to and out of circulation…One of the great advantages of the time-varying deposit fee is that its implementation only involves modifying what happens at the cash window of the central bank. When private banks come to deposit paper currency at the cash window, a fee is levied. No new regulations are needed on what the private banks do in interaction with their customers (though it might be necessary to remove any regulations that force them to treat cash on a par with electronic payment).”

“One can predict that to avoid the deposit fee banks would offer paper currency to customers at a discount. Hence, if banks are still making deposits with the central bank at all, the deposit fee would establish an exchange rate between paper currency and electronic money. In effect, ignoring transactions costs, the rate at which paper currency trades (or ‘the exchange rate’) will be equal to (1-deposit fee).”

“Levying the paper currency deposit fee on net deposits of paper currency allows the central bank to create an exchange rate at the cash window between electronic currency and paper currency, so that in a negative interest environment, the value of paper currency can be caused to depreciate over time relative to electronic money…The mechanism…is a way to make deeper negative interest rates possible, adding to the monetary policy toolkit.”

Consequences for retail payments

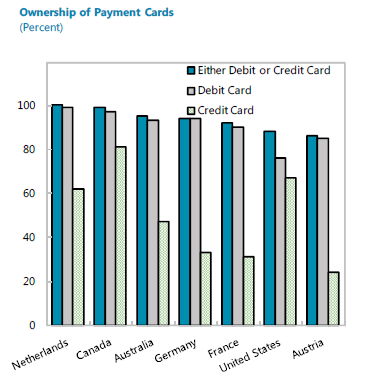

“While this exchange rate would hold throughout the financial system, it need not hold at retail shops that deal regularly with both cash and credit or debit cards. As it is, in the United States, for example, many retail shops accept at par credit card payments that are worth as little as 96 cents or 97 cents on the dollar to them after credit card fees, even in states where treating cash payments and credit or debit card payments differently is fully legal.”

“Considering the case of businesses that perceive a low cost of handling cash, up to a deposit fee of several percent, the gap between what they get in the end from cash as opposed to credit or debit card payments would actually shrink if paper currency were below par when deposited in the bank, making it even more likely that all types of payments would be treated on a par at retail than now.”

Costs and obstacles

“The most important cost of having paper currency away from par is a psychological cost….In an electronic money system, the paper dollar, euro, yen or pound that was at least symbolically the centerpiece of the old monetary system is being pushed to the periphery of the system….This psychological distress, however little rational basis it has, is likely to translate into a political cost for the central bank, especially at the inception of the policy.”

“There would be some additional computational costs associated with a non-par exchange rate for paper currency. For businesses, this is much easier than many other accounting issues. For households, a surcharge on certain cash purchases is no more complex than sales taxes in the US, which are only assessed at the time of final sale— something that residents of the US have grown quite accustomed to. And even that cost is only incurred by households when there is pass-through.”

“One more significant cost is the unintentional distortion of the meaning of debt contracts and additional transactions costs incurred from physical transportation of paper currency if there is an option of making payments with below-par paper currency at face value. This cost can be avoided or greatly reduced in two cases: (1) if it is possible to pass a law stating that monetary amounts in all contracts should be interpreted as referring to quantities of electronic money or the equivalent in paper money at the current exchange rate; or (2) if the typical debt contract has a clause stating that this is how payments should be assessed whenever paper currency is away from par.”