A long-term empirical study finds two fundamental links between market volatility and financial crises. First, protracted low price volatility leads to a build-up of leverage and risk, making the financial system vulnerable in the medium term (Minsky hypothesis). Second, above-trend volatility indicates (and causes) high uncertainty, impairing investment decisions and raising the near-term crisis risk.

Danielsson, Jon, Marcela Valenzuela and Ilknur Zer (2015), “Learning from History: Volatility and Financial Crises”, Working Paper, September 2015

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2664275

The below are excerpts from the paper. Headings, links and cursive text have been added.

On analogous empirical evidence of two channels of volatility effects of equity returns view post here.

The two channels of volatility effects

“Theoretical literature suggests that economic agents react to volatility deviating from what they expect it to be…Low volatility induces risk taking, which only materializes during a crisis, while high volatility is a signal of a pending crisis.”

“Higher-than-expected levels of volatility indicate higher uncertainty regarding future cash flows and discount rates, and hence, future economic conditions….The real options literature emphasizes that if the volatility of future payoffs increases [the implied uncertainty would be] delaying investment…Such unexpectedly high volatility can therefore be seen…as a signal of the increased risk…and a pending crisis. We term this chain of events as the high volatility channel.”

On the evidence of flight-for-quality effects in high-volatility times view post here.

“Unexpectedly low volatility may also lead to a crisis, via what we denote the low volatility channel…Minsky’s instability hypothesis suggests that economic agents interpret the presence of a low risk environment as an incentive to increase risk-taking. That would create a channel for low volatility to endogenously increase the probability of market turmoil and an eventual crisis…Similarly…the volatility paradox…[shows] how low fundamental risk leads to higher equilibrium leverage and hence, the build-up of systemic risk.”

On the volatility paradox view posts here (academic view) and here (practitioner’s view) .

“One possible link between volatility and crises is related to the risk-taking behaviour of asset managers. Expectations of low risk may encourage asset managers to reach for yield by investing large positions in riskier asset classes. Similarly, risk measures, such as Value-at-Risk or Sharpe ratios, are commonly used by risk managers of financial institutions to control the risk-taking of traders where for a given risk threshold, lower volatility allows a trader to take more risky positions.”

A long-term empirical study

“An OECD member country suffers a banking crisis every 35 years, on average…In order to obtain meaningful statistical relationships between volatility and crises, it is helpful to take the long-term historical view.”

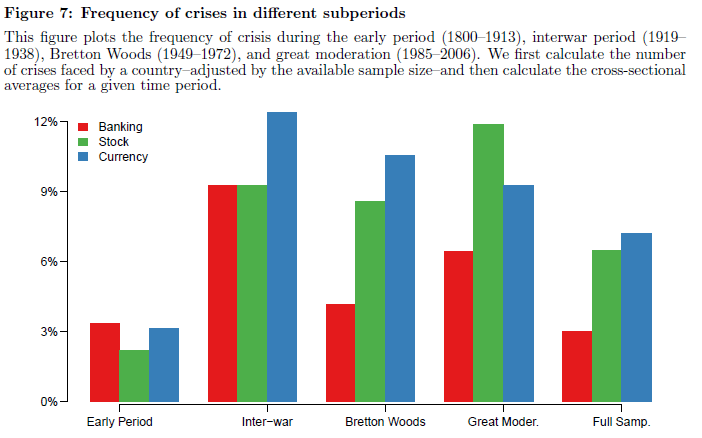

“We study the effects of volatility on the probability of financial crises by constructing and using a cross-country database spanning 211 years…We collect monthly stock market returns from which we construct annual volatility estimates. The sample covers 60 countries. The coverage is fairly comprehensive, with 262 banking crises, 419 stock market crises, and 540 currency crises.”

“Only the United States and Great Britain are available from 1800, while France, Germany, and Australia become available from the mid-19th century. It is however only post-World War I that a large number of countries developed stock markets. The figure [below]…shows that emerging countries have more volatile stock markets than developed countries…The annual stock market volatility of emerging countries averages 23%, compared to 16% for developed countries….Within the periods we consider, financial volatility is the highest during the 1985- 2006 period, with the interwar years not far behind.”

“Volatility exhibits a slow moving non-linear trend. Borrowing terminology from the literature on output gap, we interpret this slow run trend as long-term expected volatility…Unexpectedly high and low volatility (or just high and low volatility) are then deviations of volatility from above and below its trend, respectively.”

Empirical findings

“We find unambiguous support for the simultaneous presence of high and low volatility channels.”

“It is not volatility, but the unexpected levels of volatility that conveys information about future crises…The impact depends on the type of crisis; for stock market crises, high volatilities are most important, while for banking crises low volatilities dominate, whereas volatility does not impact the incidence of currency crisis in most cases.”

“We empirically demonstrate that low volatility may lead to higher risk-taking, which in turn affects future crises…Low volatility predicts stock market crises that happen half a decade or more into the future…We focus on the relationship between volatility and commonly used proxies for the risk-taking of financial intermediaries [such as the credit-to-GDP gap], finding that unexpectedly low volatility significantly increases risk-taking…we find strong support that unexpectedly low levels of financial volatility are followed by credit booms.”

“We find that the relationship between financial market volatility and the incidence of a crisis becomes stronger over time, not surprising considering that prior to World War I stock markets played a much smaller role in the economy….The volatility-crisis relationships become stronger when financial markets are more prominent and less regulated.”